DASHBOARD: Digital infrastructure valuation comps for March 2025

- Publisher : Venture Insights

- Publish Date : April 7, 2025

This Digital Infrastructure Valuation report provides a comprehensive analysis of key financial metrics for digital infrastructure stocks listed in Australia, New Zealand, and the broader regional market. It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

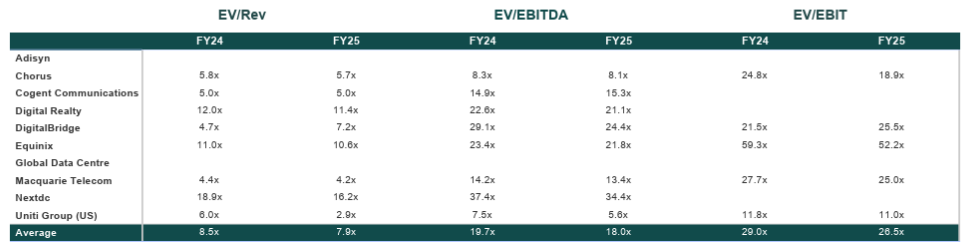

Figure 1: Digital infrastructure share price changes March 2025

Source: Firehawk

Key developments

Overall, listed digital infrastructure stocks in the region have seen wide spreads in performance among the group. Growth in cloud and AI is improving sentiment towards DC stocks, but economic growth is expected to be sluggish relative to previous years, creating uncertain performance for Digital Infrastructure equities. More recently, an investor turn against tech stocks has weighed on the sector.

NextDC

NextDC’s stock has fallen by around 14% during March, consistent with its performance so far in 2025 where it has shed a quarter of its value. This is in line with similar data centre and AI related stocks which investors have recently taken some of the heat out of since the massive rally’s seen during 2023 and 2024. The company reported its 1H25 results in late February, which showed relatively neutral performance of revenue down 2% and EBITDA up 3% compared to 1H24. Also, in that release was reaffirmed FY25 guidance of net revenue in the range of $340-350m and EBITDA in the range of $210-220m.

DigitalBridge

DigitalBridge’s stock has dropped just over 22% in March, with the downturn reflecting broader market sentiment for certain technology exposed stocks investors perceive as overvalued. During March, DigitalBridge announced that its portfolio company Zayo, which it acquired in partnership with EQT in 2020, will acquire Crown Castle’s Fiber Solutions business in a transaction valuing the business at ~US$4.25 billion. The acquisition will strengthen Zayo’s ability to deliver high-performance connectivity solutions to businesses and service providers. Marc Ganzi, CEO of DigitalBridge, commented that the company “remains committed to investing in world-class network infrastructure to power AI, cloud computing, and enterprise connectivity.”

Macquarie Technology Group

Macquarie Technology Group’s stock has fallen just over 7% during March, with the stock now down 28% for 2025. The fall in valuation can be tied to a cooling in investors’ enthusiasm towards data centre and AI demand. In late February, the company released its 1H25 results which included modest revenue growth of 1% to $183.6m from $181.3m in 1H24, while EBITDA grew by 6% to $56.2 from $53m in 1H24. The release highlighted future guidance, including that FY25 EBITDA is expected to be approximately $112 to $115 million which includes Macquarie Data Centres’ EBITDA of $36 to $37 million, and that the company is continuing its strategic investment across the Group to drive future profitable growth.

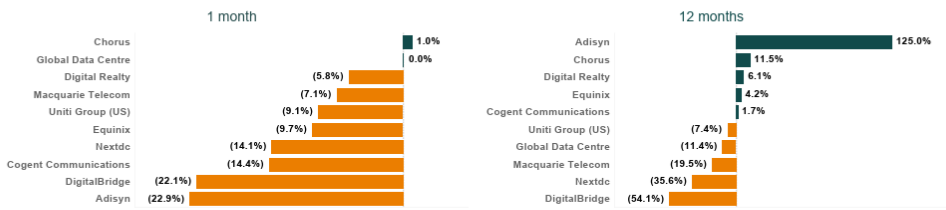

Figure 2: Digital infrastructure valuation multiples March 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.