DASHBOARD: Digital infrastructure valuation comps for April 2025

- Publisher : Venture Insights

- Publish Date : May 2, 2025

This Digital Infrastructure Valuation report provides a comprehensive analysis of key financial metrics for digital infrastructure stocks listed in Australia, New Zealand, and the broader regional market. It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

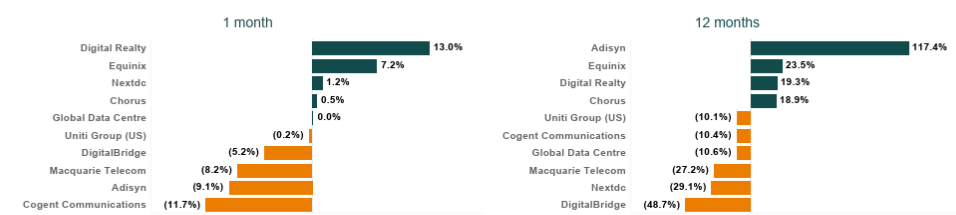

Figure 1: Digital infrastructure share price changes April 2025

Source: Firehawk

Key developments

Overall, listed digital infrastructure stocks in the region have seen wide spreads in performance among the group. Growth in cloud and AI is improving sentiment towards DC stocks, but economic growth is expected to be sluggish relative to previous years, creating uncertain performance for Digital Infrastructure equities. More recently, an investor turn against tech stocks has weighed on the sector.

Digital Realty

Digital Realty’s stock climbed 13% during April with the company releasing favourable first quarter 2025 results. The company posted revenues of US$1.4 billion for the quarter, a 2% decrease from the previous quarter and a 6% increase from the same quarter last year, but adjusted EBITDA was US$791 million for the quarter, a 5% increase from the previous quarter and an 11% increase over the same quarter last year. Digital Realty President & CEO Andy Power commented on the results, “Robust demand across our key product segments drove strong leasing”.

Cogent Communications

Cogent Communications’s stock fell nearly 12% in April, which can be explained by the ongoing sell-off the stock has experienced post the company’s release of its full year 2024 results on February 27. The results included reported adjusted EBITDA of US$348.4 million, dropping from US$352.5 million in 2023. Also, fourth-quarter revenue of US$252.3 million had missed the analyst consensus estimate of US$258.04 million. Since the release, the stock has dropped over 30%.

Macquarie Technology

Macquarie Technology’s stock dropped around 8% in April with the stock now down over 30% since the beginning of 2025. In late February, the company released its 1H25 results which included modest revenue growth of 1% to $183.6m from $181.3m in 1H24, while EBITDA grew by 6% to $56.2 from $53m in 1H24. Despite the S&P ASX All Technology Index rebounding by 7% during April, investors continued to sell-off Macquarie Technology.

Figure 2: Digital infrastructure valuation multiples April 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.