DASHBOARD: Telco valuation comps for June 2025

- Publisher : Venture Insights

- Publish Date : July 7, 2025

This Telco Valuation Comps report provides a comprehensive analysis of key financial metrics for telco stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

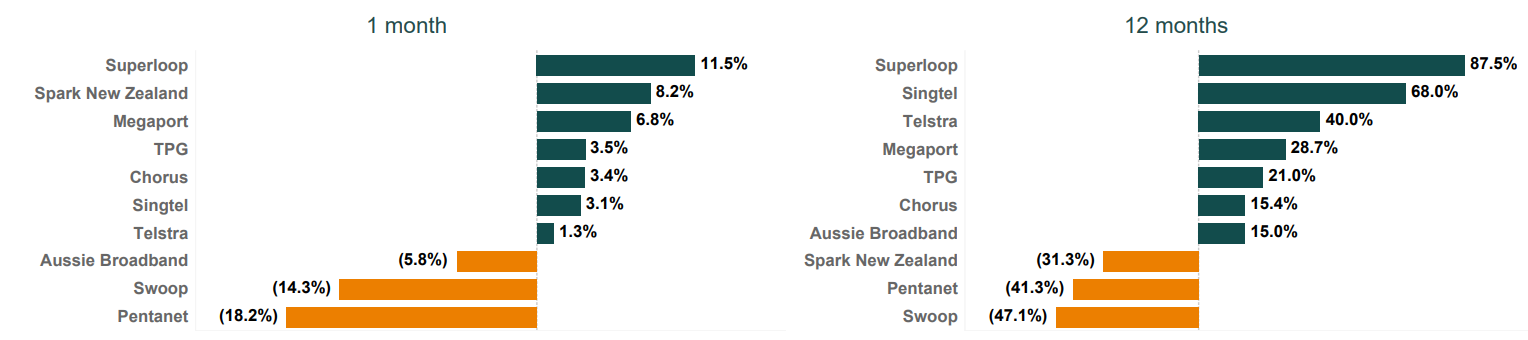

Figure 1: ANZ Telco share price changes June 2025

Source: Firehawk

Key developments

Telco stocks in Australia and New Zealand have seen wide spreads in performance over the last 12 months. Economic growth is expected to remain sluggish relative to previous years, creating uncertain performance for telco equities, though some challengers are doing better.

Superloop

Superloop’s stock jumped 11.5% during June as investors reacted to the company’s upgrade FY25 guidance release in late June. The release stated that the ongoing strong trading performance across the business has resulted in an increased underlying EBITDA guidance for FY25 which is expected to be at or above $91 million. This is above the top of Superloop’s existing guidance range of $83–$88 million provided in August 2024 and represents an increase of over 67% from FY24 underlying EBITDA.

Spark New Zealand

Spark New Zealand’s share price rose by 8% during the month despite no price sensitive announcements by the company in the period. However, the company did announce that it has accepted an offer from Hutchison Telecommunications BV to sell its 10% shareholding in Hutchison Telecommunications (Australia). The release stated that ‘The decision to divest the shareholding is consistent with Spark’s current strategic review of non-core assets. The transaction is expected to deliver cash proceeds of NZ$47 million in July 2025, which will be used to reduce net debt.’

Megaport

Megaport’s stock has increased by around 7% during June, despite no price sensitive announcements being released by the company. The stock is now trading at the highest levels seen in a year. During June, the S&P ASX All Technology Index increased by 1.5%, which has performed well over the last three months (up 20%) following a fall during the first quarter of 2025 which was tied to a cooling in investors’ enthusiasm towards data centre and AI demand.

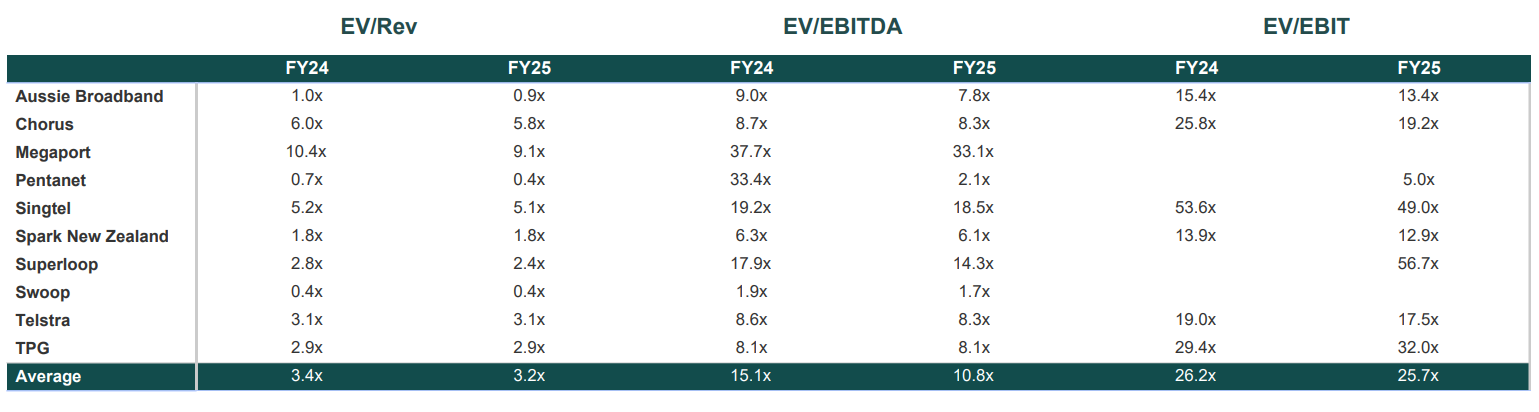

Figure 2: ANZ telco valuation multiples June 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.