DASHBOARD: Media valuation comps for June 2025

- Publisher : Venture Insights

- Publish Date : July 7, 2025

This Media Valuation Comps report provides a comprehensive analysis of key financial metrics for media stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

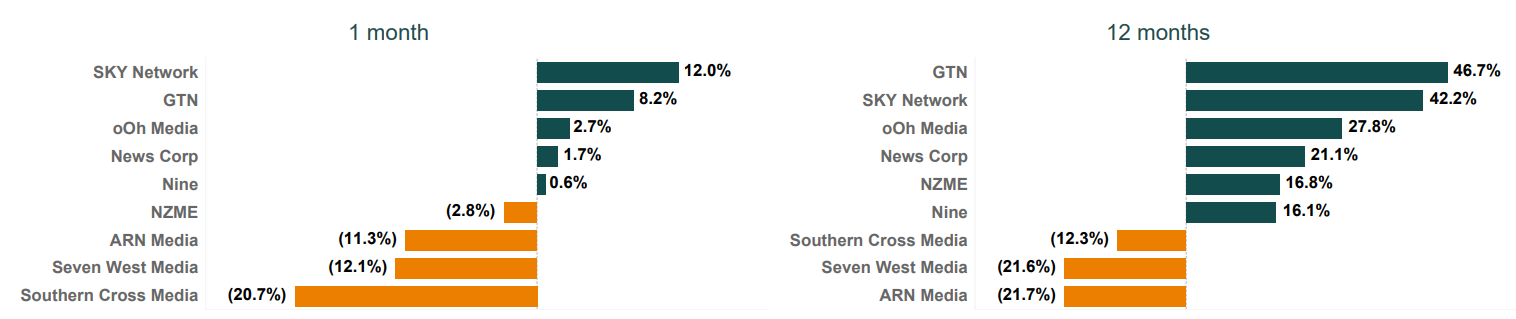

Figure 1: ANZ media share price changes June 2025

Source: Firehawk

Key developments

Overall, the media sector in Australia and New Zealand have struggled to maintain their position over the last year with the deterioration of economic conditions. Economic growth is sluggish relative to previous years, and the impact on advertising continues to depress valuations for ad-dependent stocks.

Southern Cross Media

Southern Cross Media’s stock fell by nearly 21% in June, after the company released an announcement in early May that it had entered into a binding agreement with Seven West Media to sell its television licences and associated assets operating in Tasmania, Darwin, Spencer Gulf, Broken Hill, Mt Isa and Remote, Central and Eastern Australia. The purchase price for the acquisition is $3.75 million and completion of the transaction occurred on 1 July 2025. Since the announcement, Southern Cross Media’s shares have dropped by around 27%.

GTN

GTN’s stock climbed around 8% during the month, with the company providing an FY25 earnings update that forecast that revenue will be in the range of $178 million to $182 million, compared to $184.2 million for the year ending 30 June 2024. Adjusted EBITDA for the year ended 30 June 2025 is expected to be in the range of $15.5 million–$17.5 million, compared to $22.3 million in the previous corresponding period. GTN also released an announcement during the month that it intends to seek shareholder approval for a proposed capital return of $44 million to shareholders, representing $0.023 per share.

ARN Media

ARN Media’s stock declined by around 11% during June, continuing its downwards run with the stock down around 35% over the past six months to the end of June. The last price sensitive announcement by the company was in early May, being a trading update which had headlines of total April YTD revenue finishing ~2% behind the prior comparative period, a modest improvement in gross margin for the period to date, and finally some “significant progress” in relation to its cost out program has been made as it targets $40m cash cost out over 3 years.

Figure 2: ANZ media valuation multiples June 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.