BRIEF: SVOD dominates household video as pay TV slumps

- Publisher : Venture Insights

- Publish Date : July 11, 2025

Abstract: Next week, we will publish our 2025 Video Entertainment Outlook. This week, we offer a preview.

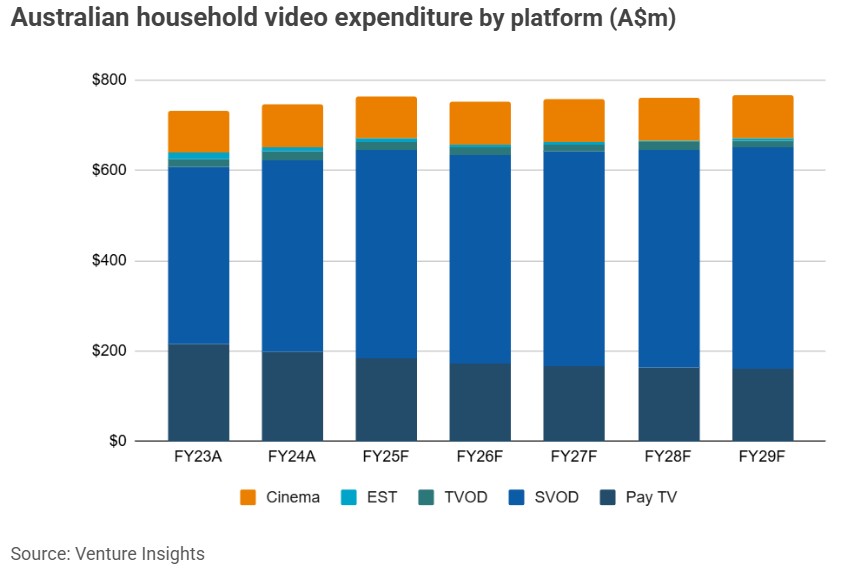

Australia video spending per household will reach a peak in FY25. This is mostly driven by SVOD, which has recovered from a reversal of subscription growth in FY24 and has seen strong price increases since FY23. It will continue to expand, mostly driven by price further increases. In contrast, Pay TV will continue to decline, while cinema spending will stabilise as declining per capita admissions are offset by higher ticket prices.

Household video spending now stable

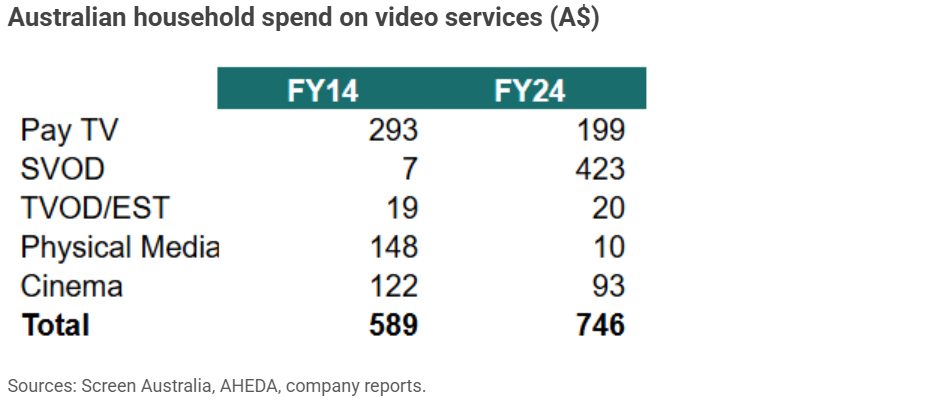

Per household spending on video products has changed dramatically over the last decade. SVOD has increased from a very low base to dominate household video spending. This has come at the expense of DVD/BluRay purchases and rentals, pay TV, and to a lesser extent cinema.

However, the pace of change is slowing as most of the “online revolution” has flowed through. Change to the end of the decade will follow the same trends, but as a slower pace:

- We expect SVOD spending to keep growing, but about two thirds of the growth is due to higher prices, and one third due to higher subscribers. We expect household penetration of SVOD services to be steady, and for subscription growth to follow household growth.

- Pay TV will continue its long-term decline, but revenue will fall more slowly than subscribers as ARPUs rise. This is due to the loss of predominantly low-end pay TV subscribers switching to cheaper SVOD products.

- TVOD (TV on demand) and EST (Electronic Sell-Through) services are a small but persistent phenomenon. We expect TVOD to rise gradually as SVOD providers market on-demand access to premium titles through their platforms. In contrast, download-to-own EST will continue its decline.

- Physical video rental has all but disappeared, while sales have declined precipitously. We foresee no change to the trend.

- Declining cinema admissions will be offset by rising ticket prices, partly through price inflation and partly through marketing of premium Gold Class experiences.

Why does this matter?

The upshot is that we don’t see much appetite for further growth in household spending on video services. This is a change from the last ten years, when we saw significant growth in overall spending mainly driven by the rise of SVOD. But SVOD penetration is plateauing, which is driving SVOD providers to milk their customers by lifting prices.

We have just been through a round of SVOD price increases in FY24/25, and expect some price stability in FY26. But if these price increases do not result in net cancellations, then we expect the industry to launch another round of increases towards the end of FY26 and FY27.

For Foxtel we foresee some tougher times as growth in Kayo and Binge levels off and pay TV subscriptions continue to decline. News Corp has timed its sale well, and new owner DAZN will need to leverage its considerable sporting assets to offset this trend.

Finally, cinema will enjoy a period of relative stability after the pandemic rollercoaster.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.