DASHBOARD: Telco and IT valuation comps for July 2025

- Publisher : Venture Insights

- Publish Date : August 6, 2025

This Telco and IT Valuation Comps report provides a comprehensive analysis of key financial metrics for telco stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

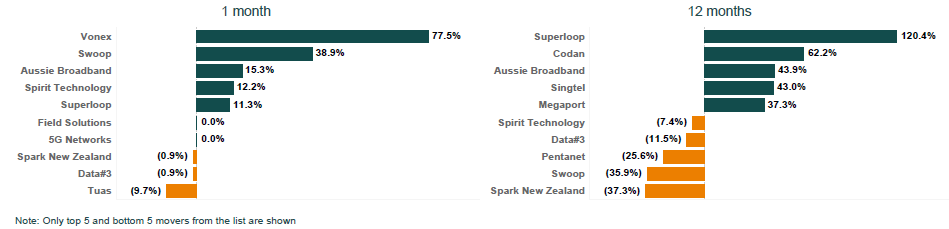

Figure 1: ANZ Telco and IT share price changes July 2025

Source: Firehawk

Key developments

Telco and IT stocks in Australia and New Zealand have seen wide spreads in performance over the last 12 months. Economic growth is expected to remain sluggish relative to previous years, creating uncertain performance for telco equities, though some challengers are doing better. Smaller companies show more volatility.

Vonex

Vonex’s stock climbed around 77% during the month, with the company announcing that it has agreed to a Scheme of Arrangement with MaxoTel, which will acquire all remaining shares of Vonex for 3.60 cents each—an 80% premium to the July 3, 2025 closing price. This share price implies an enterprise value of $34.1m of the company. Major shareholders, including MaxoTel (69.4%) and Swoop (22.8%), intend to support the scheme, with the Board recommending approval. The timetable suggests that the transaction will be complete by mid-October 2025.

Spirit Technologies

Spirit Technologies’ stock rose by around 12% during July, with the company releasing a trading update with its unaudited FY25 results, where it achieved EBITDA of $11.0 million and revenue of $102.4 million, compared to $1.7 million and $90.9 million respectively in FY24. The FY25 EBITDA was split between its Cyber Security division ($6.8 million), Communication and Collaboration division ($7.7 million) and Managed Services division ($0.3 million) which had returned to profitability after a ‘multi-year turnaround’.

Aussie Broadband

Aussie Broadband’s stock rose by 15.5% during July and reached year-high levels, despite there being no price sensitive announcements from the company. The company’s full year results are to be published on 25 August. During the month, the S&P/ASX All Technology Index performed strongly, increasing by 6%.

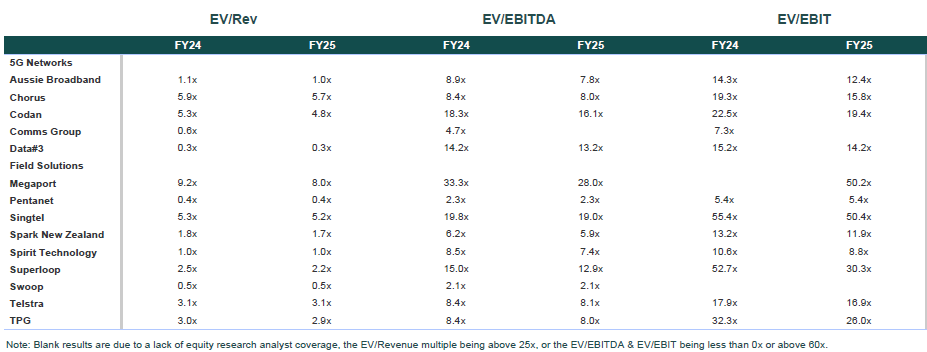

Figure 2: ANZ telco and IT valuation multiples July 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.