BRIEF: Apple and Microsoft Would Crack the ASX10

- Publisher : Venture Insights

- Publish Date : May 16, 2025

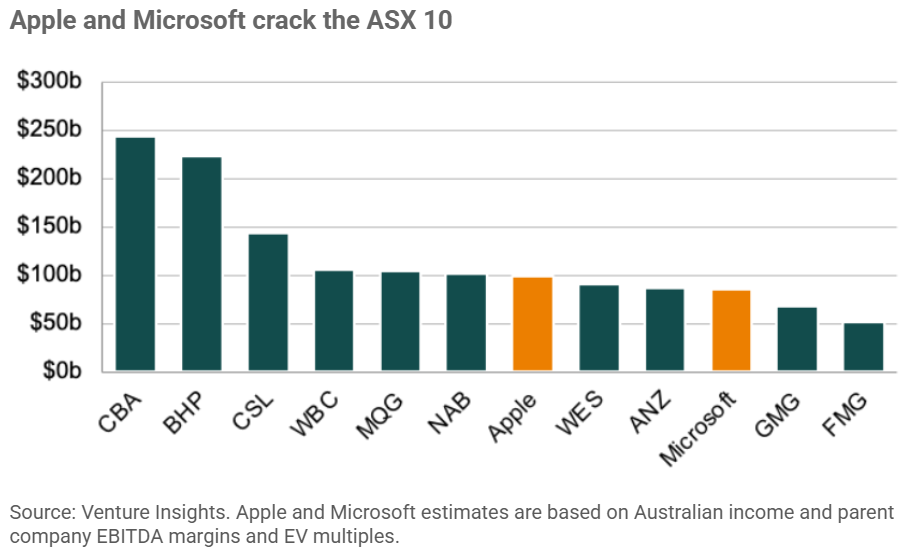

Abstract: New analysis from Venture Insights reveals that Apple and Microsoft would rank among the ten most valuable companies in Australia if their local operations were assessed independently. We estimate that Apple Australia’s implied enterprise value (EV) is $99.6 billion, and Microsoft Australia’s is $85.7 billion. However, their Australian tax contributions fall far short of what such a scale would suggest, thanks to international structuring that channels profits through low-tax jurisdictions.

These findings come as major U.S. tech firms, through the Coalition for the Advancement of the Internet in America (CIAA), argue that global digital platforms are overregulated. The Australian data tells a different story: these firms dominate local markets and enjoy considerable financial privilege, raising important questions for policymakers and local industry.

Why does this matter?

Our analysis reveals a significant structural imbalance in Australia’s TMT landscape: foreign digital platforms are operating at national champion scale while avoiding national champion obligations—particularly in taxation.

Both Apple and Microsoft would comfortably rank within the ASX 10 by Enterprise Value, even when valued solely on their Australian operations. They are simply too large to ignore.

Using publicly disclosed Australian revenue (via the ATO), applying their global EBITDA margins, and using current trading multiples, we estimate that the implied Australian enterprise values of these two companies are equivalent to some of our largest listed corporations.

From a policy and tax perspective, this raises important questions. The scale of their economic footprint in Australia – despite limited onshore substance – makes them highly material in the context of corporate tax policy, digital taxation, and global minimum tax frameworks.

At a time when free trade and global tax harmonisation are under strain, and governments are more focused on ensuring multinational tech firms pay their fair share, the presence of giants like Apple and Microsoft in the Australian economy warrants much closer attention.

Based on 2023/24 tax declarations Apple and Microsoft barely contributed to Australian taxation.

Time for a platform regulation realignment

The scale and market power of large tech has ramifications in Australia and for the heating up debate around global trade.

The CCIA in 2024 singled out Australia as a jurisdiction that imposed or was imposing “digital trade restrictions” – essentially any regulation designed to ensure global digital platforms maintained their social licence. The “barriers” concerned include the Online Safety Act, efforts to take down violent and child abuse material, efforts to address financial scams, and age restrictions on social media access. While there is room for disagreement on how such obligations should be implemented, it is clear that the CCIA opposes almost any effective regulation of global digital platforms. The CCIA has elsewhere argued against digital service taxes. We, on the other hand, support them (see our report “Time for a Digital Services Tariff?“).

Foreign tech giants are not just participating in the Australian market – they’re dominating it, both in revenue and value. But the benefits they receive from market access are not matched by their contributions, leaving domestic TMT players at a regulatory and financial disadvantage.

For a full breakdown of valuation methodology or insights into how this shapes the future competitive landscape, contact Venture Insights.

Appendix: Leading US Tech Companies implied Australian Enterprise Value

Using ATO-declared Australian revenues, we applied global EBITDA margins and EBITDA multiples to estimate Enterprise Value (EV) for Australian operations.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.