BRIEF: Fixed wireless keeps up the pressure on fixed broadband

- Publisher : Venture Insights

- Publish Date : September 27, 2024

Abstract: In Australia, NBN faces rising competition from various sources, including Uniti and TPG fibre, LEO satellites, and MNO fixed wireless providers. After a slowdown in 2023, FWA growth is picking up, continuing to pressure NBN. A figure around 900 thousand FWA services by FY28 is plausible. As FWA grows, calls for a level playing field in regulatory requirements may increase. MNOs find FWA more profitable than NBN resale, making the risk worthwhile despite potential policy issues.

FWA pricing gap driving takeup?

The last twelve months has seen two significant wholesale price changes by NBN. The first was in December 2023, following the approval of the Special Access Undertaking. The second was in July 2024, representing the annual price increase for FY25. Basic and Standard tier plans have generally increased in price, while prices for Superfast and Ultrafast NBN tiers have fallen significantly.

In contrast, FWA prices have remained relatively stable over the same period. Higher Basic and Standard NBN prices have therefore widened the gap between the price of 4G and 5G FWA plans on these lower tiers, relative to their nearest equivalent NBN plans. All else constant, this increases the appeal of FWA plans and may provide an opportunity for FWA providers to grow their subscribers in the coming year.

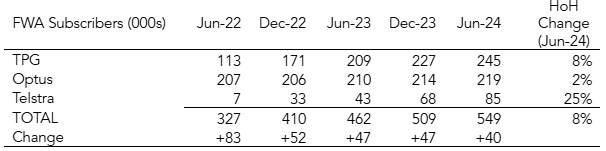

As we noted in our report ‘Slowing wireless growth & the rise of broadband challengers’, the number of wireless broadband (FWA) subscribers in Australia has been growing, but that growth had been slowing. Until recently, our analysis suggested Telstra has been building momentum in this space, TPG is still growing but more slowly, and Optus relatively is stable.

All three of Australia’s MNOs reported growth in FWA subscribers during the December 2023 half. Overall Dec-23 FWA growth of +47k services was slightly lower than Jun-23 (+52k). But while the overall volume was only slightly down in that half, the three operators saw different results. TPG saw the strongest growth, adding +18k FWA subscribers, while Telstra followed closely at +17k. Optus FWA saw minimal growth, adding just +5k services, similar to the prior half.

Figure 1: Fixed Wireless subscribers (MNOs)

Source: Company financial reports, media reports, investor presentations. Note this table was revised in Feb 2025 to correct a typographical error.

Optus’ FWA performance up to now has been sluggish, despite Telstra and TPG clearly showing that there is customer appetite for FWA. In the June-24 quarter, Optus introduced more aggressive promotional offers on its 5G Home Internet plans. These plans are already $15-$20pm cheaper than Optus’ corresponding NBN plans and we observed Optus offering an additional $10-$20pm off for the first six months, on top of its existing offer of ‘first month free’.

So far this is not showing up in Optus’ subscription growth data, but these offers had little time to make a difference by June 30. We will be watching Optus’ FWA numbers later this year with interest.

Why does this matter?

As we have noted before, NBN faces rising competition from several sources:

- Uniti and TPG fibre in green fields and brownfields settings respectively.

- LEO satellite, which has graduated from rural offer to a full blown alternative to terrestrial broadband.

- MNO fixed wireless and other specialised fixed wireless network providers.

After a 12 month period in 2023 when FWA expansion slowed, growth is picking up again, and the June 2024 half growth was the highest since the June 2022 half.

FWA will continue to place NBN under competitive pressure, but NBN is probably betting that household preferences will shift back to higher speed services as economic conditions improve, leaving FWA behind. A shift of some sort is likely, but FWA speeds are adequate for many households.

Eighteen months ago we wondered if FWA might reach a million subscriptions by FY28. This now seems less likely, though a figure approaching 900 thousand still seems plausible. As FWA grows, we expect there will be calls from fixed infrastructure providers such as NBN Co and Uniti for a more level playing field, especially in the application of separation requirements and the RBS levy.

This is a risk the MNOs think is worth taking. On-net margins are better than NBN margins, so FWA contributes to better profitability. Given the pressure on capital returns (see our report “Five-Year Telecommunications Industry Outlook 2024”), this is not surprising. But continued growth in FWA will trigger policy interest. Right now, we haven’t reached that point.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to www.ventureinsights.com.au or contact us at contact@ventureinsights.com.au