BRIEF: Media market trends ensure a SCA TV deal – sooner or later

- Publisher : Venture Insights

- Publish Date : October 4, 2024

Abstract: Media reports have emerged of discussions between Southern Cross Austereo (SCA) and the Ten and Seven networks to sell SCA’s regional TV assets to their metropolitan affiliates. Even if this round of negotiations goes nowhere, a deal like it is inevitable. The metropolitan networks can get incremental value out of regional broadcasting through synergies with their national BVOD services. Meanwhile, SCA sees its future in audio.

SCA TV faces tough environment

Regional TV’s share of total FTA TV ad revenue has dropped from 24% to 20% over the last ten years. Much of this is driven by the growth of BVOD in regional areas, which is owned and controlled by the metro networks.

SCA faced an additional challenge after Nine shifted its affiliate relationship from SCA to WIN in 2021, leaving SCA with no choice but to cut a deal with the lower-rating Ten network in its key regional Queensland, Southern New South Wales, and Victoria markets. This shift reduced SCA’s affiliate costs, but also reduced its TV advertising revenue.

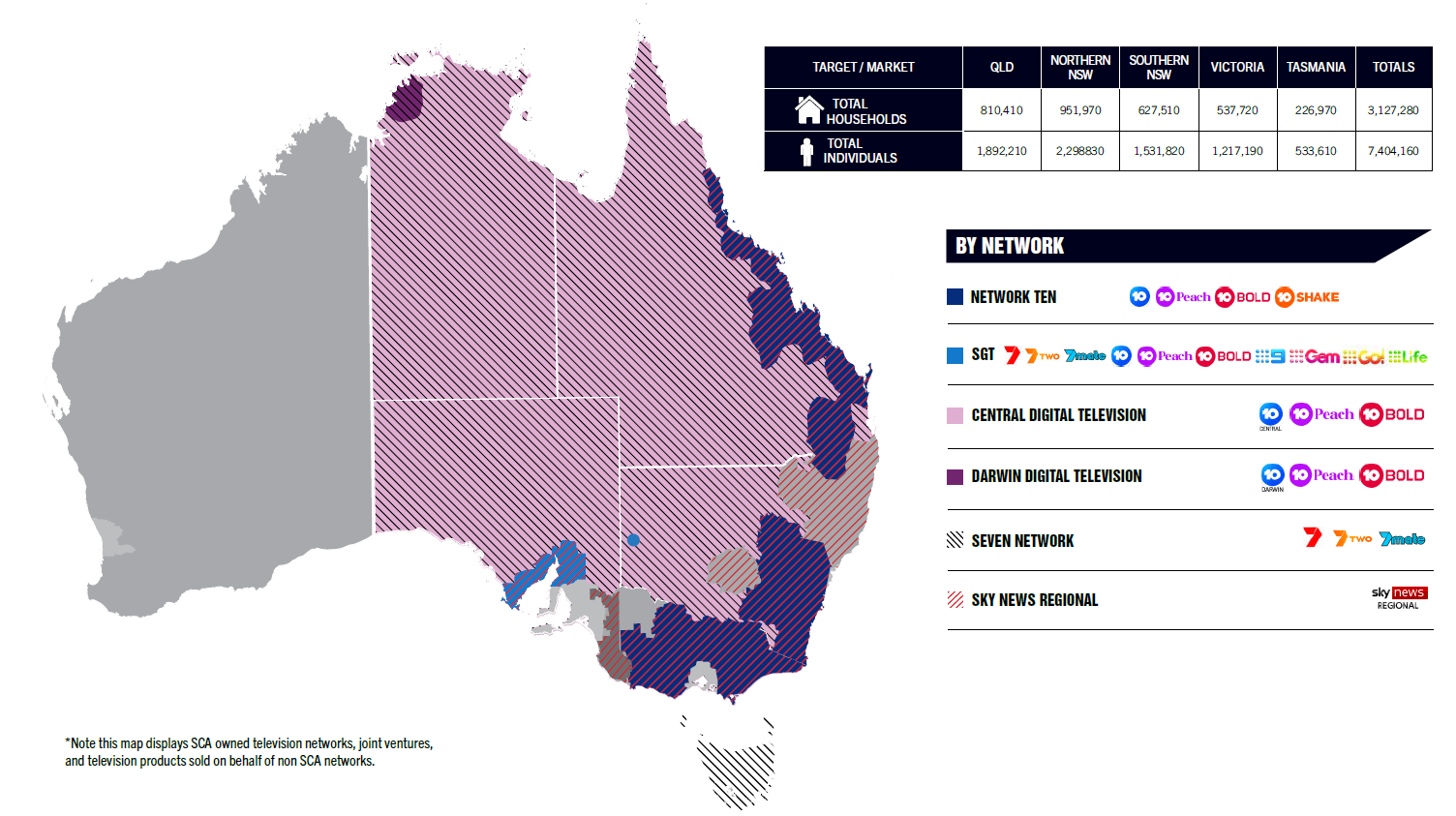

Figure 1: SCA regional coverage by affiliate network, 2021

Source: SCA, 2021, downloaded at https://www.southerncrossaustereo.com.au/media/3338/tv_coverage_maps_oct_2021.pdf

Finally, the current slump in ad spending has hit free-to-air TV hard. Revenue at Southern Cross’ regional TV stations fell 9% in FY24 to reach $97.5m, while EBITDA fell 29% to only $13.3 million.

Why does this matter?

The AFR published a story this week about discussions between SCA, Seven, and Ten on the future of SCA’s TV assets. Seven and Ten are SCA’s main metropolitan affiliates, so all of the participants needed for a comprehensive deal are engaged.

There has been regular speculation about the sale of SCA’s TV assets. The company itself has been clear: it sees its future in its radio and online audio assets (i.e. the LiSTNR network), and the synergies it can generate between them. While TV can assist in this aim, it is only an adjunct by comparison.

At the same time, the major metropolitan TV networks are leaning into their digital BVOD offerings, available nationally thanks to the NBN. A key element of their BVOD growth strategy is cross-promotion between their broadcast and online platforms. So the lack of a broadcast network in regional areas (which comprise around 30% of households) is a big gap in their promotional efforts.

The 2017 abolition of the 75% TV reach limit opened up the way to consolidation of metropolitan and regional TV networks. The results have been slow, but began with Seven’s acquisition of the regional Prime network in 2021. In the background, metropolitan networks and their regional affiliates have been consolidating marketing efforts and sales desks, increasingly offering a single face to the market.

The sticking issue has always been SCA’s required price for its TV assets. But with SCA TV’s earnings in steep decline, there is a chance for a meeting of minds. SCA knows better than anyone that the pressure on regional TV will not abate. And the decline in earnings means that the price for these assets will now be more attractive than before.

But if this round of discussions collapses (like so many before), that is not the end of the matter. We have argued that such a deal would have benefits for both sides (see our report “SCA negotiations with Ten overshadowed by structural tensions”). The underlying drivers make a deal similar to this one virtually inevitable.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.