BRIEF: Time for a Digital Services Tariff?

- Publisher : Venture Insights

- Publish Date : May 9, 2025

Abstract: Analysis from Venture Insights reveals that the five largest U.S. tech companies operating in Australia — including Apple, Microsoft, Google, Meta (Facebook), and Amazon — are collectively paying only around a quarter of the corporate tax they would be expected to contribute if taxed fully under Australia’s standard corporate tax rate.

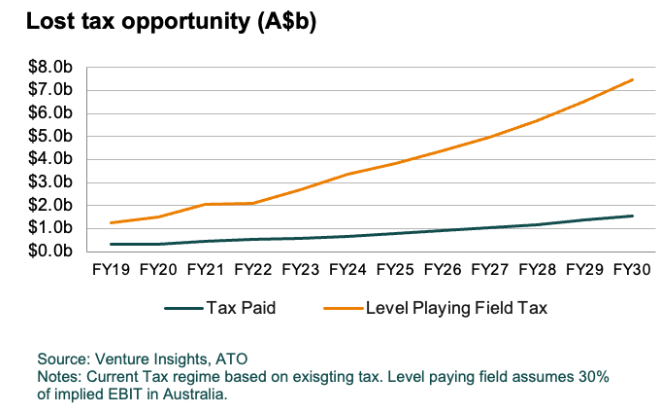

This results in a shortfall of $1.5 billion per year — and a cumulative lost tax revenue opportunity of approximately $11 billion by FY2025. With these companies continuing to expand rapidly in Australia — especially through AI-led growth — this gap is expected to double to $22 billion in the coming years unless addressed.

With the US Administration’s decision to levy a 100% tariff on foreign-produced movies, the gloves are off. A Digital Services Tariff (DST) would act as a levelling mechanism, ensuring that global tech giants contribute equitably to the economies from which they extract value.

Growing tax gap disadvantages local firms

We have documented the effects of tax avoidance and market dominance by the global tech companies in earlier reports. This is not only an unacceptable competitive distortion for local businesses but also a significant revenue loss for the Australian public.

While these firms paid an estimated $500 million in tax in FY2023, a look-through analysis based on declared local income and global margins suggests their true tax obligation should be closer to $2.0 billion annually. The current tax regime leaves around $22b of lost tax opportunity from global digital platforms over the next five years, and penalises Australian corporates.

A competitive disadvantage — and a public revenue crisis

This disparity gives multinational tech firms a massive pricing and margin advantage over local Australian TMT, retail, and media businesses, who are fully exposed to Australia’s 30% corporate tax rate. For domestic firms, this is not just a tax issue — it is a market distortion that threatens their viability in sectors ranging from digital advertising to cloud infrastructure and e-commerce.

It also represents a significant opportunity cost to the Australian public. Over $11 billion in forgone revenue could have funded healthcare, education, infrastructure, or national digital policy. Key global tech companies will exceed $80b Australian revenue by 2030, based on reasonable assumptions. As the growth of these companies accelerates — particularly through AI services and platform expansion — the shortfall is likely to exceed $22 billion in the coming five years.

Policy response: a Digital Services Tariff

Just as governments once used tariffs on physical imports to protect local manufacturing and agriculture, the modern equivalent must now be applied to the import of digital services. A Digital Services Tariff (DST) would act as a levelling mechanism, ensuring that global tech giants contribute equitably to the economies from which they extract value.

This is not a radical concept — it is simply catching up with history. As the U.S. imposed tariffs to protect domestic manufacturing, countries like Australia now have every right to recoup what has effectively been “ripped off” through decades of regulatory lag in taxing cross-border digital trade.

With the move from the merchandise era into the information era, our tax and trade frameworks are outdated. A Digital Services Tariff would help to address that gap, and we estimate that a DST on imports of tech services of around 9% would roughly equate to a level playing field.

Why does this matter?

- Unfair Advantage: Local businesses pay full tax; global tech avoids it. This is not sustainable in a competitive economy.

- Lost Sovereignty: Revenue that should support public services is leaking offshore.

- Rising AI Acceleration: With no structural checks in place, AI may deepen platform dominance, widening the tax gap further.

- Moral Obligation and social licence: Everyday Australians and SMEs are taxed fairly — it is only fair that the world’s largest and most profitable firms do the same and contribute to the societies where they operate

As the global economy shifts deeper into the digital and AI era, and services imports are targeted by the US Administration, Australia must act decisively. The introduction of a Digital Services Tariff is not protectionism — it is economic realism, and a necessary step to restore fairness in a skewed system.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.