DASHBOARD: Digital infrastructure valuation comps for July 2025

- Publisher : Venture Insights

- Publish Date : August 6, 2025

This Digital Infrastructure Valuation report provides a comprehensive analysis of key financial metrics for digital infrastructure stocks listed in Australia, New Zealand, and the broader regional market. It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

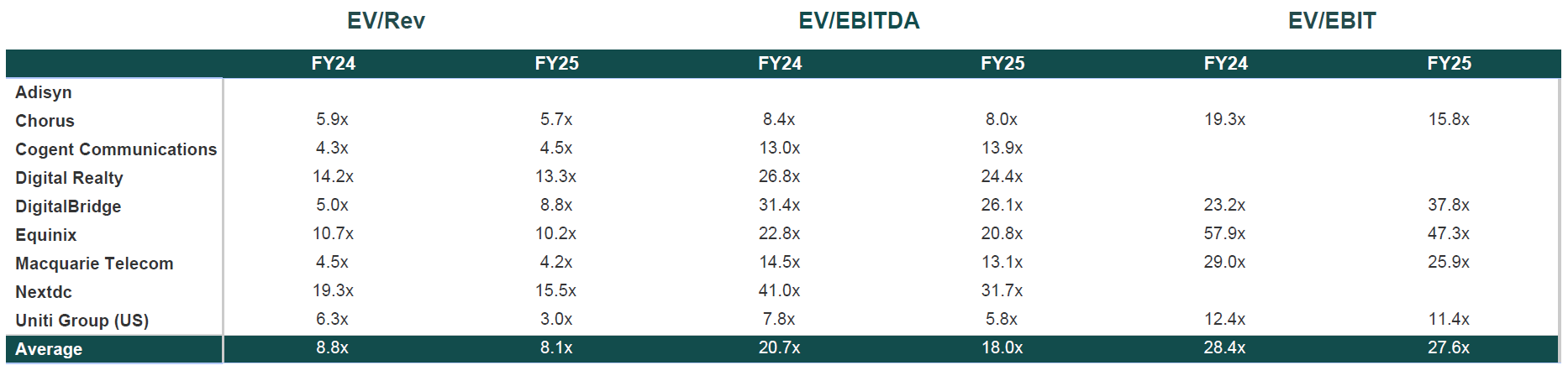

Figure 1: Digital infrastructure share price changes July 2025

Source: Firehawk

Key developments

Overall, listed digital infrastructure stocks in the region have seen wide spreads in performance among the group. Growth in cloud and AI is improving sentiment towards DC stocks, but economic growth is expected to be sluggish relative to previous years, creating uncertain performance for Digital Infrastructure equities. More recently, an investor turn against tech stocks and “AI hype” has weighed on the sector.

Macquarie Technology Group

Macquarie Technology Group’s stock increased by around 5% during July, with the company announcing that it has entered into arrangements alongside an established property developer to ‘purchase a large parcel of land for a new data centre campus in Sydney’. The company stated that it intends to construct a new data centre campus in stages that is expected to deliver more than 150 MW of IT load. The campus will be designed for hyperscale customers, AI, cloud and government workloads. The purchase price for the land is $240 million and is intended to be funded through existing cash reserves and the company’s debt facility.

Adisyn

Adisyn’s stock launched by around 59% during the month, with the microcap stock announcing that its current generation Atomic Layer Deposition (‘ALD’) system had been successfully installed, tested and commissioned at A1’s research facility. According to the company, the development enables ‘significant process capability gains over legacy development system in process parameters, precision control, speed and throughput’. The company’s goal by developing this system is to create ‘low temperature graphene solution for interconnect semiconductor technology to advance the next generation high performance chips.’

Uniti Group (USA)

Uniti Group’s stock jumped around 23% during the month, as result of the anticipated confirmation of the merger with Windstream (which has been confirmed on 1 August). President and CEO of Uniti, Kenny Gunderman commented “we are thrilled to be crossing the finish line on our transformational merger with Windstream. This transaction creates a premier insurgent fiber provider that is uniquely positioned to accelerate the delivery of mission-critical, high-capacity connectivity to the businesses and communities across our footprint. Bringing these two organizations fully together unlocks tremendous opportunity for our customers, employees and stockholders, and I could not be more excited about the growth potential and innovation we will drive as one company.”

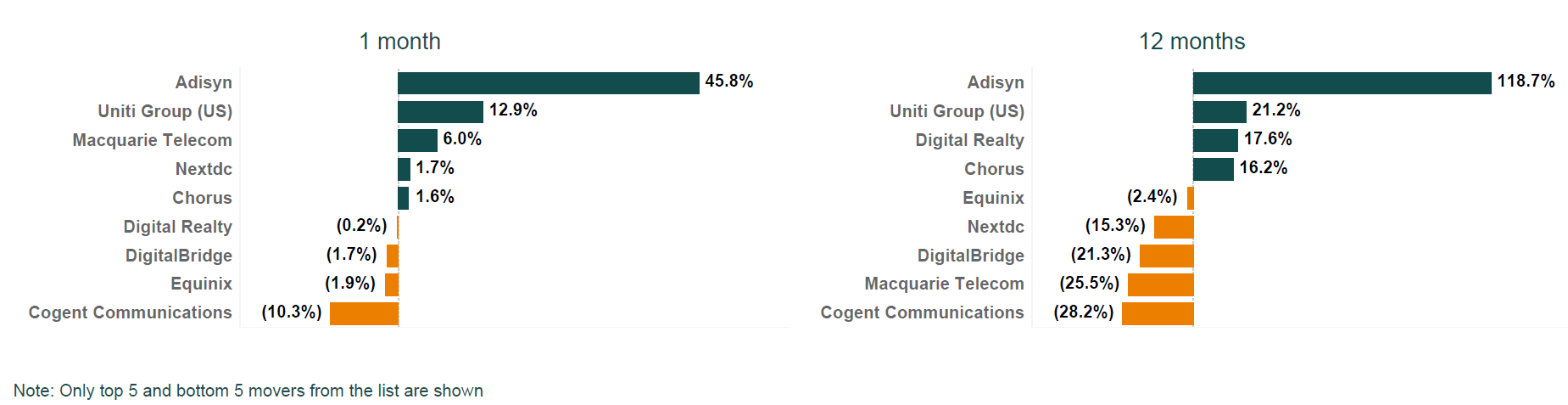

Figure 2: Digital infrastructure valuation multiples July 2025

![]()

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia and New Zealand.