DASHBOARD: Digital infrastructure valuation comps for June 2025

- Publisher : Venture Insights

- Publish Date : July 7, 2025

This Digital Infrastructure Valuation report provides a comprehensive analysis of key financial metrics for digital infrastructure stocks listed in Australia, New Zealand, and the broader regional market. It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

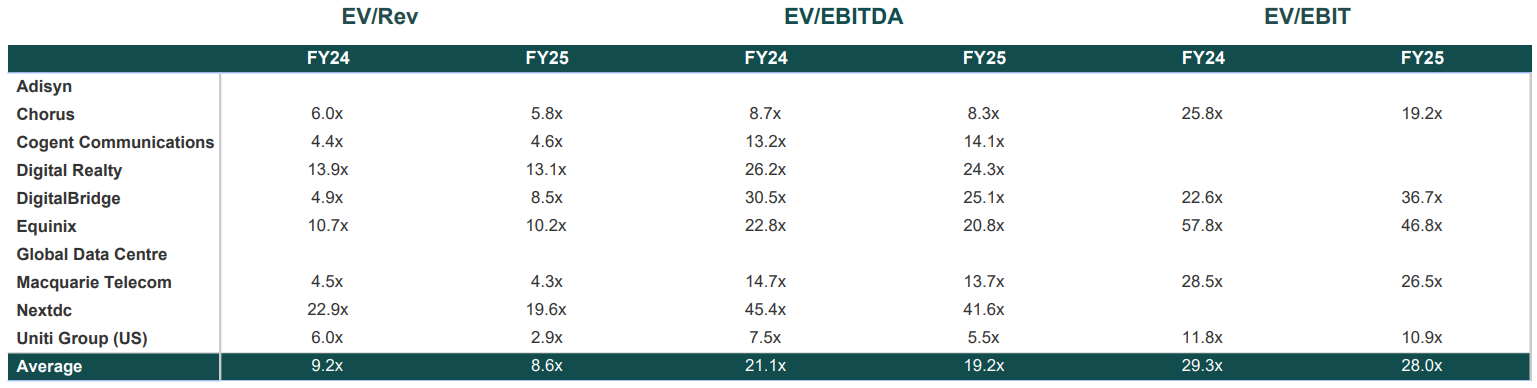

Figure 1: Digital infrastructure share price changes June 2025

Source: Firehawk

Key developments

Overall, listed digital infrastructure stocks in the region have seen wide spreads in performance among the group. Growth in cloud and AI is improving sentiment towards DC stocks, but economic growth is expected to be sluggish relative to previous years, creating uncertain performance for Digital Infrastructure equities. More recently, an investor turn against tech stocks has weighed on the sector.

NextDC

NextDC’s stock increased by around 11% during the month after the company announced that following recent customer contract wins, its pro forma contracted utilisation has increased by 16MW (7%) to 244MW in less than a month. The largest increase in contracted utilisation has come from NextDC’s data centre under development in Kuala Lumpur, Malaysia (KL1). Commenting on the development, Craig Scroggie, CEO & Managing Director, said “KL1 represents a strategic milestone in NextDC’s Asia expansion and reinforces our commitment to delivering sovereign, AI-native digital infrastructure across high-growth regional markets.” In June, the company also announced that it has entered into a binding agreement with debt providers for a new $2.2b senior debt facility, with a maturity date of December 2030.

Equinix

Equinix’s stock fell 10.5% during June as investors reacted to the company’s new long-term targets released at its annual analyst day in late June. The targets include 7% to 10% revenue growth through 2029, and an EBITDA margin projected to hit at least 52% by 2029 as it increases its data centre capacity to meet growing demand. UBS analysts said the targets were in line with estimates over the long-term, but “point to a near-term slowdown” in profit growth as it invests more to drive sales.

Adisyn

Adysin’s stock continued its volatility in June, with the microcap declining by 33%. During the month the company announced that the Israel Innovation Authority had approved the completion of its graphene R&D program, with the project focused on initial demonstration of low-temperature graphene deposition used for next-gen semiconductor performance in AI and high-performance computing. The total approved grant of A$520,000 represents 50% of project costs. The company Chair, Kevin Crofton commented “the final approval from the IIA represents more than finding, it is a strong endorsement from one of the worlds most credible innovation agencies.”

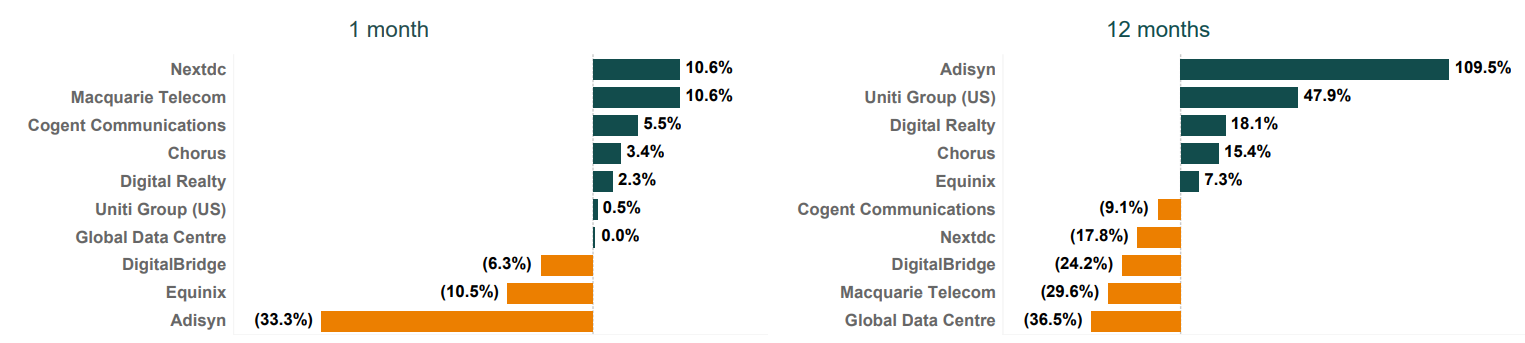

Figure 2: Digital infrastructure valuation multiples June 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.