DASHBOARD: Digital infrastructure valuation comps for May 2025

- Publisher : Venture Insights

- Publish Date : June 13, 2025

This Digital Infrastructure Valuation report provides a comprehensive analysis of key financial metrics for digital infrastructure stocks listed in Australia, New Zealand, and the broader regional market. It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

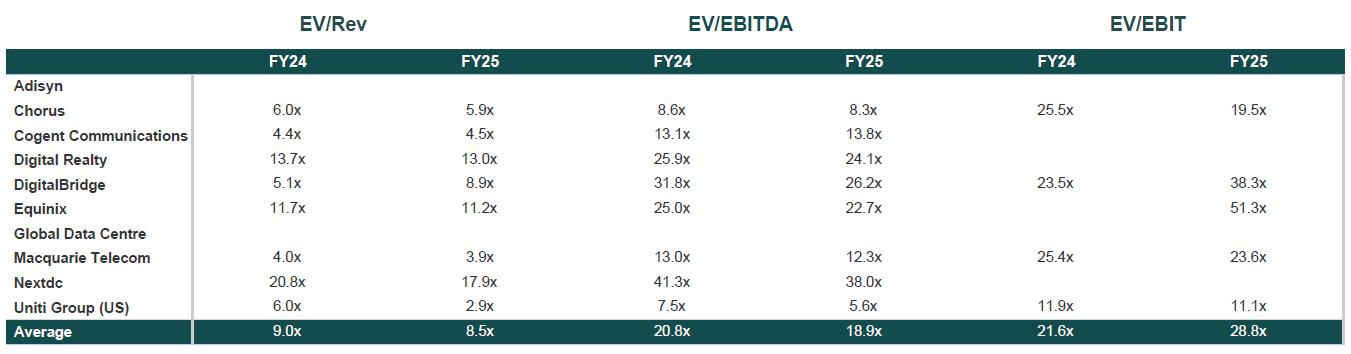

Figure 1: Digital infrastructure share price changes May 2025

Source: Firehawk

Key developments

Overall, listed digital infrastructure stocks in the region have seen wide spreads in performance among the group. Growth in cloud and AI is improving sentiment towards DC stocks, but economic growth is expected to be sluggish relative to previous years, creating uncertain performance for Digital Infrastructure equities. More recently, an investor turn against tech stocks has weighed on the sector.

DigitalBridge

DigitalBridge’s stock surged by around 32% during May, with unconfirmed reports that 26North Partners (a specialist in alternative investments) is in advanced talks to acquire DigitalBridge. Energy trader Mercuria is said to be joining the bid. The market reacted strongly to the rumour with the stock jumping 37% in the space of four days. Several reports suggest the deal is at such an advanced stage that it could be finalised within days.

NextDC

NextDC’s stock increased by around 11% during the month after the company released a statement on its guidance and contracted utilisation. On FY25 guidance, the company’s capex has been increased by $100 million for the year (to $1,400 million to $1,600 million) as NextDC accelerates a proportion of its’ planned inventory expansion, with the additional capex required to build and deploy capacity for the new customer contract wins. The FY25 Net Revenue and Underlying EBITDA guidance remained unchanged in the release. Secondly, the company’s contracted utilisation was reported to have increased by 52MW (30%) to 228 MW in the three months since 31 December 2024.

Adisyn

Adysin’s stock climbed by 32% during May, with the microcap stock rebounding after some volatile months. During the year, the stock had more than halved from its peak in January and is showing signs of recovery across the past two months. Adysin’s primary field is its development of novel technologies and methods to produce high-quality graphene, in a low-temperature process, targeting semiconductor interconnect and other applications.

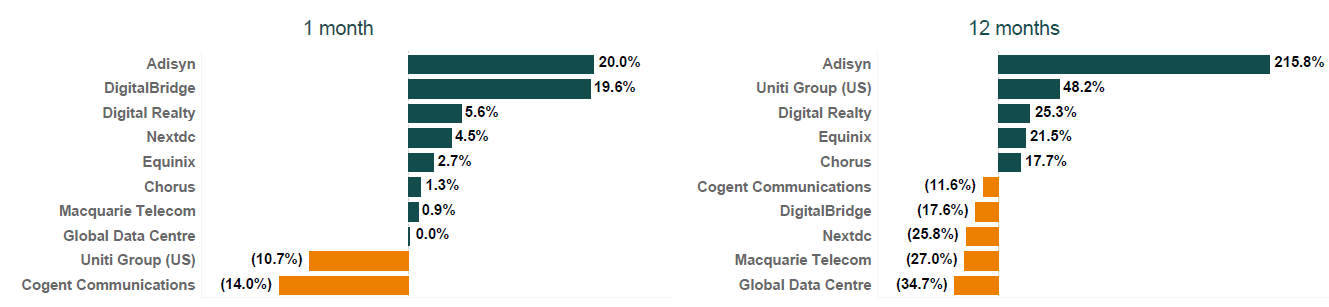

Figure 2: Digital infrastructure valuation multiples May 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.