DASHBOARD: Enterprise ICT valuation comps for April 2025

- Publisher : Venture Insights

- Publish Date : May 2, 2025

This Enterprise ICT Valuation report provides a comprehensive analysis of key financial metrics for enterprise ICT stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

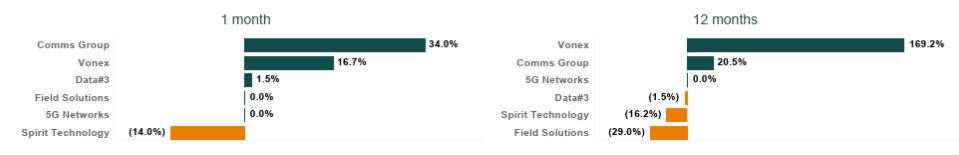

Figure 1: ANZ enterprise ICT share price changes April 2025

Source: Firehawk

Key developments

Enterprise ICT stocks in Australia and New Zealand showed mixed performance over the last year. Overall, economic growth is expected to be sluggish relative to previous years, creating uncertain performance for enterprise ICT equities. Some of these companies are growing through acquisition rather than organically, and are exposed to any economic downturn.

Data#3

Data#3’s stock rose by around 2% during April, despite no price sensitive announcements being released since the company’s 1H25 results from late February. Those results included gross sales growth of 7.4% on the prior corresponding period to $1.4b and EBIT up 4.6% on the prior corresponding period to $26m. The company also raised its dividends per share by 4% during the period. The stock’s slight rebound in April may have occurred as the stock had hit its three-month low on April 7, at which point the stock was trading on a relatively low P/E multiple in the low 20’s.

Comms Group

Comms Group’s stock jumped by around 34% during April, which saw the company release a favourable trading update. The release included total revenue (unaudited) for March of $5.0m, which was the highest monthly revenue on record for Comms Group. The company’s Global revenue segment delivered $1.36m in March which was 26% higher than the average monthly revenue of $1.08m for the first half FY25. The revenue was boosted by the inclusion of revenue from several new domestic and multi-national corporate customers provisioned within the quarter. The release also highlighted strong new business in the company’s pipeline and the reaffirmed earlier FY25 revenue guidance $55m to $57m and FY25 Underlying EBITDA guidance of $5m to $6m.

Spirit Technology

Spirit Technology’s stock fell 14% in April. The stock had experienced a continued sell-off since the company released its 1H25 results which showed negative growth, with revenue 14% lower compared to 1H23, reflecting a decline over two years. Additionally, Spirit Technology’s Managed Services division saw a drop in revenue to $16.9m in 1H25 from $14.9m in 1H24. The company commented that it is focussing on ‘stabilising and restructuring this segment in an effort to return it to positive earnings momentum’. The stock found its bottom in late April and has lifted since.

Figure 2: ANZ enterprise ICT valuation multiples April 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.