DASHBOARD: Enterprise ICT valuation comps for May 2025

- Publisher : Venture Insights

- Publish Date : June 13, 2025

This Enterprise ICT Valuation report provides a comprehensive analysis of key financial metrics for enterprise ICT stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

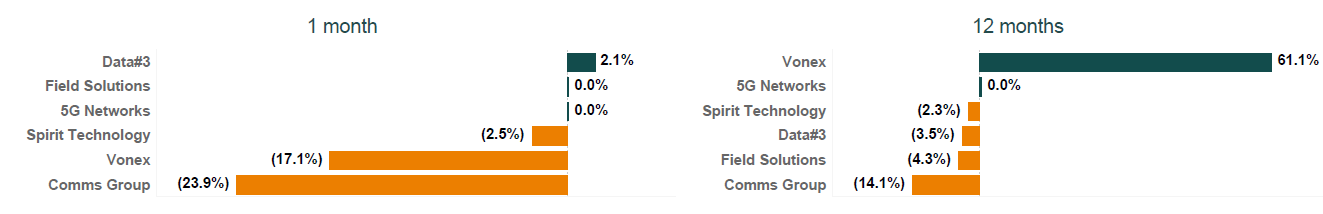

Figure 1: ANZ enterprise ICT share price changes May 2025

Source: Firehawk

Key developments

Enterprise ICT stocks in Australia and New Zealand showed mixed performance over the last year. Overall, economic growth is expected to be sluggish relative to previous years, creating uncertain performance for enterprise ICT equities. Some of these companies are growing through acquisition rather than organically, and are exposed to any economic downturn.

Comms Group

Comms Group’s stock fell by 24% during May, with the microcap stock announcing to the market that is has signed a binding agreement to acquire TasmaNet, a leading provider of premium communication and managed IT services to the Tasmanian Government and businesses in Tasmania. The company described the acquisition a “highly strategic, adding key network assets, corporate and government customers and delivering significant expected revenue increase to ~$75m pa with expected underlying annualised EBITDA of $9m to $10m”. The purchase price is reported as $10m, $7m of which to come from an equity raising and the remainder from a debt facility provided by Regal Funds Management.

Vonex

Vonex’s stock declined by around 17% during the month, with the company releasing its 1H25 results. The company posted revenue of $23.2m (a year-on-year decrease of 6%) and an EBITDA of $2.4m (a year-on-year increase of 24%). Highlights for the half were Vonex’s $13.9m capital raise, planned $13m reduction in outstanding $22.8m debt facility (and refinancing balance of facility), and the appointment of Michael Blake as CEO and Director in March.

Data#3

Data#3’s stock rose by around 2% in May, despite no price sensitive announcements being released since the company’s 1H25 results from late February. Those results included gross sales up 7.4% on the prior corresponding period to $1.4b and EBIT up 4.6% on the prior corresponding period to $26m. The company also raised its dividends per share by 4% during the period. The stock’s has increased by around 20% since its two-year low on 13 January 2025.

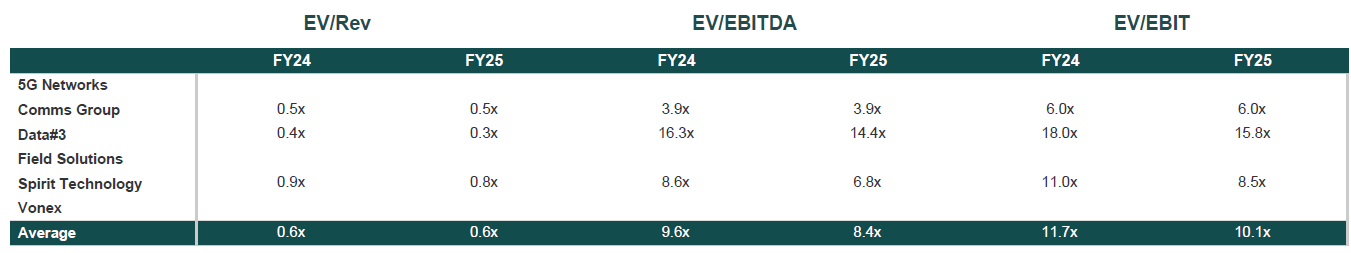

Figure 2: ANZ enterprise ICT valuation multiples May 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.