DASHBOARD: Media valuation comps for April 2025

- Publisher : Venture Insights

- Publish Date : May 2, 2025

This Media Valuation Comps report provides a comprehensive analysis of key financial metrics for media stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

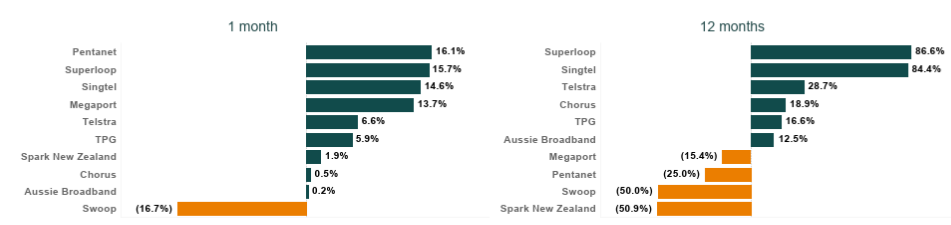

Figure 1: ANZ media share price changes April 2025

Source: Firehawk

Key developments

Overall, the media sector in Australia and New Zealand have struggled to maintain their position over the last year with the deterioration of economic conditions. Economic growth is sluggish relative to previous years, and the impact on advertising continues to depress valuations for ad-dependent stocks.

Seven West Media

Seven West Media’s stock dropped close to 10% during April, with the company’s last price sensitive announcement being its 1H25 results in mid-February. The results showed poor financial performance with a 6% decline in revenue compared to the prior corresponding half, and a sharp reduction in EBITDA and EBIT of 26% and 33% respectively on the prior corresponding half. The company pointed to an ‘ongoing soft market’ to explain results, and undertook to implement a ‘cost out program’ during FY25. The company’s stock has declined by over 22% since the release.

Nine

Nine’s stock dropped by around 7% during April, despite any price sensitive announcements. The stock had experienced a continued sell-off since the company released its 1H25 results which showed a drop in profitability, with group EBITDA dropping 15% to $268.4m from $316.1m. The release included commentary that it is focussing on increasing the efficiency of its cost base and that there is ‘expected to be further restructuring into H2 FY25 and FY26’. The stock found its bottom in late April and has lifted since.

ARN Media

ARN Media’s stock declined around 7% during April, despite no price sensitive announcements. The stock is close to its 12-month low and has fallen by around 21% since the start of 2025. The stock has experienced a continued sell-off since the company released its full year 2024 results which showed modest revenue growth, an increase in EBITDA to $93.1m from $71.6m in 2023. However, NPAT halved to $14.3m from $32.3m in 2023 with steep increases in lease finance costs and lease depreciation. The release pointed to some highlights for the year including a new leadership team and the commencement of a 3-year transformation program to deliver $40m of cost out and transition to a fully digitised audio business.

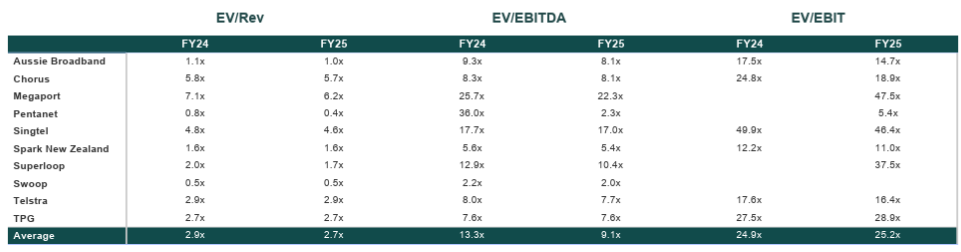

Figure 2: ANZ media valuation multiples April 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.