DASHBOARD: Media valuation comps for July 2025

- Publisher : Venture Insights

- Publish Date : August 6, 2025

This Media Valuation Comps report provides a comprehensive analysis of key financial metrics for media stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

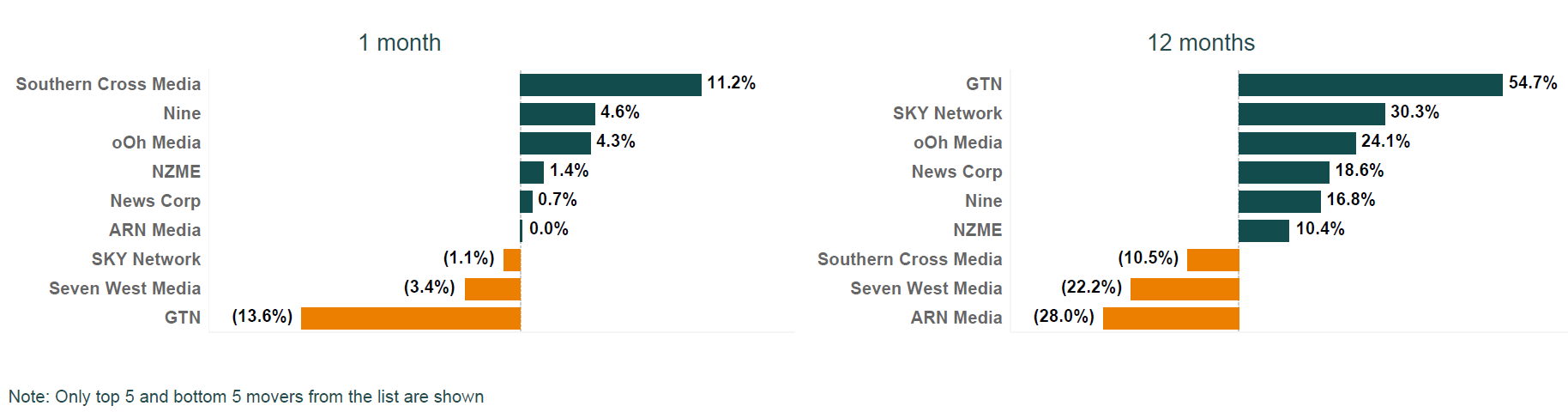

Figure 1: ANZ media share price changes July 2025

Source: Firehawk

Key developments

Overall, the media sector in Australia and New Zealand struggled to maintain their positions over 2024 with the deterioration of economic conditions. The impact on advertising depressed valuations for ad-dependent stocks. More recently, there are signs of green shoots as economic conditions improve.

Southern Cross Media

Southern Cross Media’s stock increased by around 11% during the month, as the company completed the sale of its remaining television assets to Seven West Media (SWM), fully exiting the TV sector to focus on its ‘All About Audio’ strategy. The total consideration, including $3.75 million in SWM proceeds and $15–$20 million from profit share on the sale of 3 regional TV licences to Network Ten, is estimated at $19–$24 million. Proceeds will be used to reduce net debt, and the transaction represents an FY25 proforma EBITDA multiple of approximately 4–5 times.

oOh!media

oOh!media’s stock rose by around 4% during the month, despite the company announcing it had been notified by Auckland Transport that its advertising contract, expiring on 30 September 2025, will not be renewed. The contract accounted for 4% of FY24 revenue, but the company remains confident in its position within the New Zealand Out Of Home market. The company highlighted its diverse lease maturity and disciplined contract management as it continues focusing on sustainable margin, earnings growth, and capital returns.

Nine

Nine’s stock increased by around 4.5% during July, and closed in on near year-high levels despite there being no immediate price sensitive announcements from the company. However, Nine Entertainment is selling its 60% stake in the real estate platform Domain to US-based CoStar Group for approximately $3 billion. This deal will result in Nine receiving about $1.4 billion for its share, which is expected to be partly returned to shareholders as a special dividend. The sale is subject to regulatory approvals and a shareholder vote, which is anticipated to occur in mid-August. In addition, on 30 June the company announced that via its Stan subsidiary, it will acquire selected Optus Sport assets – including media and subscriber agreements – for $20 million upfront, with additional contributions from Optus through to 2028. The deal, which includes Premier League and FA Cup rights through the 2027/2028 seasons, is expected to be both EBITDA and cash positive for Stan over the term of the agreements.

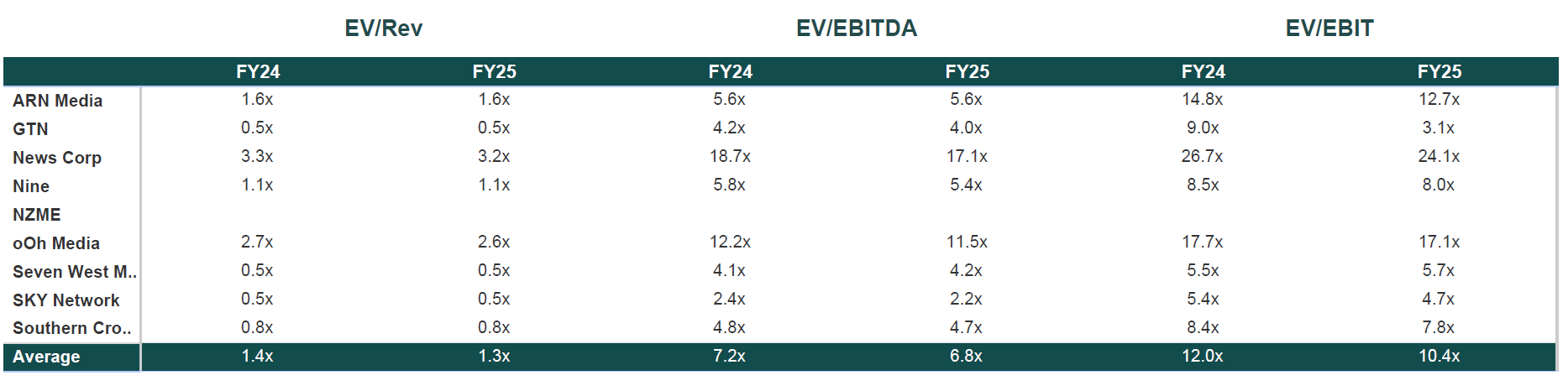

Figure 2: ANZ media valuation multiples July 2025

![]()

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.