DASHBOARD: Telco valuation comps for April 2025

- Publisher : Venture Insights

- Publish Date : May 2, 2025

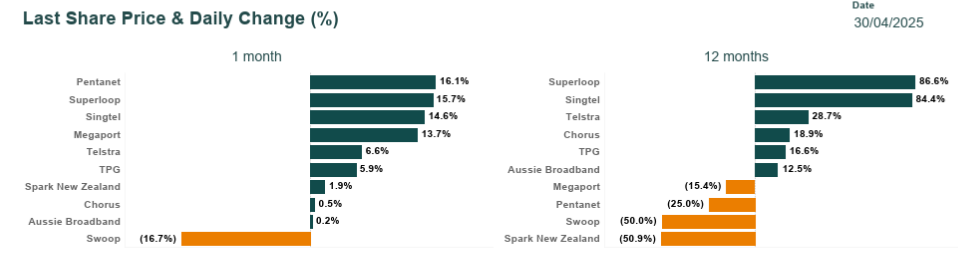

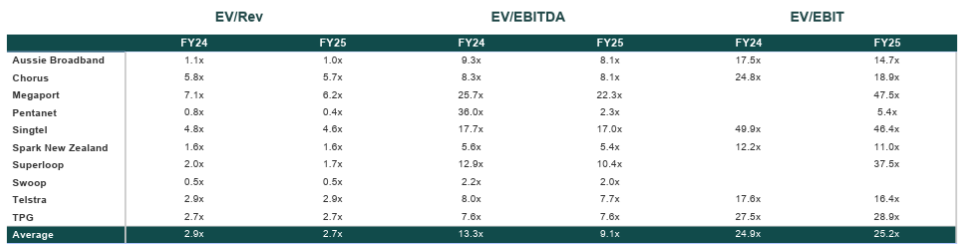

This Telco Valuation Comps report provides a comprehensive analysis of key financial metrics for telco stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

Figure 1: ANZ Telco share price changes April 2025

Source: Firehawk

Key developments

Telco stocks in Australia and New Zealand have seen wide spreads in performance over the last 12 months. Economic growth is expected to remain sluggish relative to previous years, creating uncertain performance for telco equities, though some challengers are doing better.

Singtel

Singtel’s stock lifted around 6% in March despite any noteworthy company announcements. In late February the company released a positive December quarter business update which included modest YoY growth in revenue and EBITDA, while EBIT growth for the quarter was 6.2%. Over the last six months Singtel’s stock has increased by over 22%.

Megaport

Megaport’s stock has risen by nearly 14% during April, rebounding after a 24% drop since the release of the company’s mixed 1H25 results in late February . The stock is now trading at the highest since August 2024. During April, the S&P ASX All Technology Index increased by 7%, showing signs of a rebound following a fall during the first quarter of 2025 which was tied to a cooling in investors’ enthusiasm towards data centre and AI demand.

Pentanet

Pentanet’s stock increased by around 16% during April, with the company releasing Q3 FY25 financial results reporting strong profitability growth. Highlights included EBITDA growth of 17% QoQ to $0.7m, which was the second consecutive quarter of positive EBITDA. In addition, total revenue increased by 10% on PcP, gross profit increased 21% on PcP, and gaming revenue was up 29% on PcP. Another key takeaway was that the doubling of the company’s 5G coverage across FY25 is on track.

Figure 2: ANZ telco valuation multiples April 2025

Source: Firehawk

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.