EXPLAINER: The ANZ LEOSat market takes shape

- Publisher : Venture Insights

- Publish Date : July 24, 2025

Executive Summary

The Low Earth Orbit (LEO) satellite market in Australia and New Zealand (ANZ) is undergoing a profound transformation. From a niche connectivity solution for the most remote users, it is now evolving into a mainstream offer with the power to disrupt the established telecommunications landscape.

This report provides an analysis of the current market structure and competitive dynamics of LEO satellite services in the region. This market is currently characterised by a dominant direct-to-consumer operator, Starlink, and a focused enterprise-grade challenger, OneWeb. Smaller contenders such as Lynk Global and AST SpaceMobile have trial agreements with some telecommunications operators to deliver handset services. Major new entrants are poised to intensify competition.

Incumbent telecommunications operators have adopted a sophisticated strategy of “co-opetition.” They are forming tactical partnerships with LEO providers to immediately extend their service reach, particularly for Direct-to-Mobile (D2M) capabilities, while simultaneously investing in sovereign and alternative constellations. This dual approach aims to mitigate the long-term strategic risks of dependency on what are, fundamentally, new competitors.

The disruptive impact of LEO services is most acute for legacy geostationary (GEO) satellite services, such as NBN Co’s Sky Muster and the Optus GEOSat fleet, which are now facing intense competition due to the performance advantages of LEO technology.

Furthermore, LEO broadband is beginning to compete directly with fixed wireless and even some NBN fixed-line offerings in areas where terrestrial performance is suboptimal. But the primary impact on 5G mobile networks is not one of direct competition for speed, but rather a complementary relationship, with LEO services providing essential backhaul and coverage-infill capabilities in areas unserved or underserved by terrestrial infrastructure.

Despite rapid growth, the LEO sector faces substantial challenges. The financial model is predicated on immense upfront capital expenditure (CAPEX) with a long and uncertain path to a sustainable return on investment (ROI). Emerging network congestion, a consequence of rapid subscriber growth on a finite satellite capacity, poses a significant threat to long-term service quality.

Concurrently, operators and their enterprise clients must navigate an increasingly complex regulatory environment. The issue of data sovereignty is becoming a critical, market-defining factor.

Looking ahead, the ANZ market is set for a new phase of evolution. The anticipated arrival of major global players like Amazon’s Project Kuiper and Canada’s Telesat will further segment the market and intensify competition. The long-term landscape will be shaped by the interplay of three powerful forces: the societal and commercial demand for ubiquitous connectivity, the strategic and geopolitical imperative for sovereign control over critical data infrastructure, and the fundamental, challenging economics of launching and maintaining constellations of thousands of short-lifespan satellites.

The ANZ LEO satellite market landscape

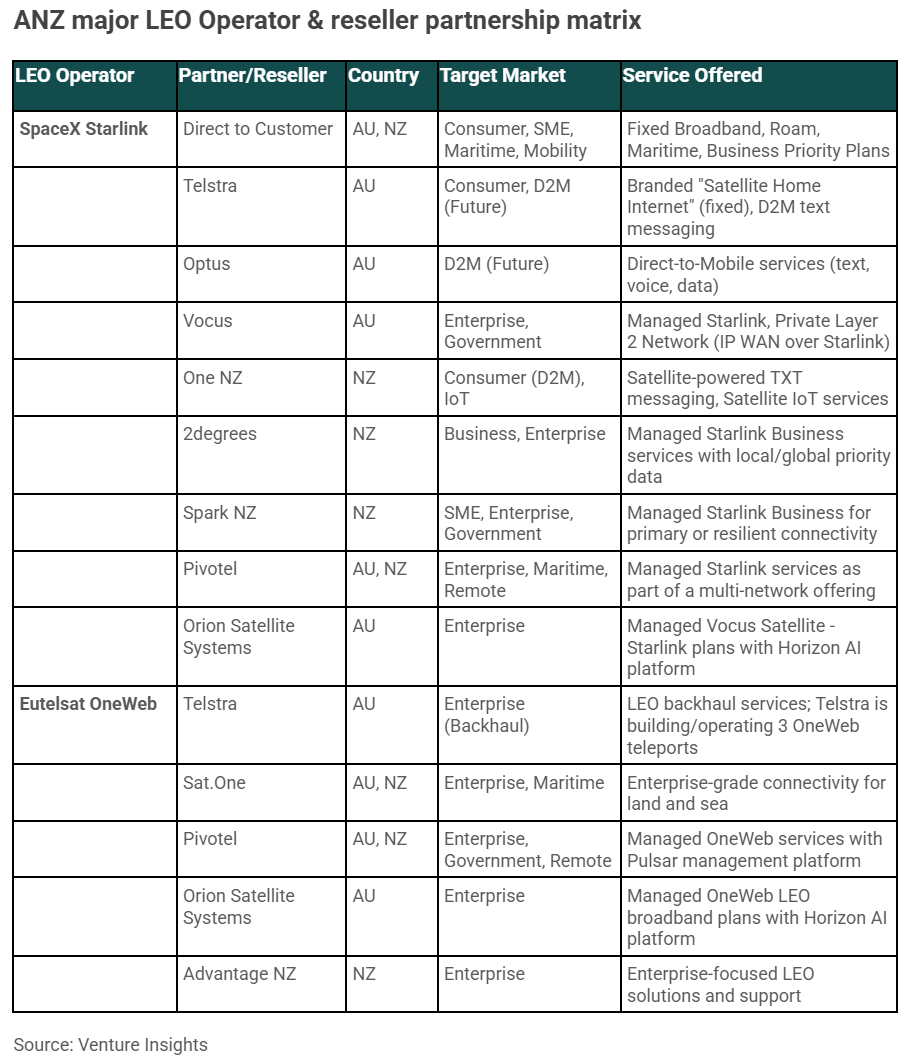

To comprehend the disruptive potential and strategic opportunities within the ANZ LEO satellite sector, it is essential to first map the ecosystem of operators and their go-to-market partners. The market is currently structured around a duopoly of primary constellation operators, each with a fundamentally different business model and target audience, supported by a complex web of partnerships with incumbent telecommunications providers and specialist satellite service companies.

Primary constellation operators

Two global LEO operators currently dominate the ANZ market: SpaceX’s Starlink and Eutelsat OneWeb. Their distinct strategies in technology, pricing, and distribution have created a naturally segmented marketplace.

SpaceX Starlink

SpaceX, through its Starlink division, has established itself as the dominant force in the consumer and small business LEO market in Australia and New Zealand. Its success is built on a vertically integrated, direct-to-market model that has rapidly achieved significant scale.

- Business Model: Starlink’s primary strategy is to sell directly to consumers (D2C) and businesses through its website. This approach bypasses the traditional telecommunications reseller channel in its core broadband product, giving SpaceX control over pricing, branding, and the customer relationship. This vertical integration extends to the manufacture of satellite and user terminals to include SpaceX launch services and the final Starlink service delivery, creating significant cost efficiencies.

- Market Penetration: Since its introduction, Starlink has seen rapid uptake, particularly in rural and remote regions of Australia and New Zealand that have long been underserved by terrestrial broadband options like the NBN or fibre. Its performance, offering significantly lower latency and higher speeds than older satellite services, has made it a compelling alternative. In New Zealand, its growth has been so substantial that it was recognized as the country’s third-largest rural broadband provider in 2024.

- Strategic Focus: While its initial beachhead was the underserved residential consumer, Starlink is aggressively expanding into adjacent markets. It now offers dedicated plans and hardware for businesses, maritime vessels, and land mobility use cases such as recreational vehicles (RVs). A pivotal new strategic direction is the development of Direct-to-Mobile (D2M) services, which promise to deliver connectivity directly to standard smartphones, representing a significant evolution of its service portfolio.

Eutelsat OneWeb

Eutelsat OneWeb operates at the opposite end of the market spectrum from Starlink. Following a 2023 merger with French satellite operator Eutelsat, the company pursues a strictly indirect, wholesale business model focused exclusively on enterprise and government clients.

- Business Model: OneWeb does not engage in direct sales to end-users. Instead, it provides wholesale satellite capacity to a curated network of distribution partners. These partners include major telecommunications carriers, such as Telstra, and specialised satellite service providers like Sat.One and Pivotel. This B2B model allows OneWeb to focus on network operations while leveraging the sales channels, customer relationships, and value-added service capabilities of its partners.

- Market Positioning: OneWeb has deliberately positioned itself as the “trusted enterprise” LEO network. Its value proposition is built on reliability, security, and guaranteed performance, which are critical for business and government applications. Unlike Starlink’s consumer-grade “best effort” service, OneWeb’s offerings are backed by formal Service Level Agreements (SLAs) and the ability to purchase Committed Information Rates (CIR), which guarantee a certain level of bandwidth. This makes it suitable for mission-critical operations where consistent performance is non-negotiable.

- Strategic Focus: The target markets for OneWeb are distinct from Starlink’s consumer base. It focuses on high-value sectors such as government, defence, maritime, aviation, and large enterprises that require robust, secure, and often private, connectivity solutions. The merger with Eutelsat created the world’s first integrated GEO-LEO operator, allowing the combined entity to offer multi-orbit solutions that blend the low-latency benefits of LEO with the established capabilities of geostationary satellites.

The telco reseller & partner ecosystem

The entry of LEO services has forced incumbent telcos in Australia and New Zealand to adapt. Rather than ceding the remote connectivity market entirely, they have entered into a series of complex partnerships, acting as both resellers for and, in some cases, future competitors to the global LEO giants.

Australia

- Telstra: Australia’s largest telco has adopted a multi-pronged LEO strategy. For the consumer market, it offers “Telstra Satellite Home Internet,” a branded fixed broadband service powered by Starlink. It is also collaborating with Starlink on the future delivery of D2M text messaging services to plug gaps in its mobile network. Simultaneously, for the enterprise and backhaul market, Telstra has a major 10-year agreement with OneWeb, which includes building and operating three dedicated teleports in Darwin, Toowoomba, and Perth to serve as OneWeb’s ground infrastructure for the Southern Hemisphere. Telstra also has a trial agreement with Lynk Global and an MOU with AST SpaceMobile.

- Optus: The nation’s second-largest telco is also pursuing D2M services in collaboration with SpaceX, although the rollout has faced delays pending regulatory approvals and technical readiness. More significantly, Optus is spearheading a consortium to build and launch ‘SWIFT’, a sovereign Australian LEO satellite, by 2028. This long-term strategic initiative, involving partners from Australian industry, academia, and Defence, signals a clear intent to develop sovereign capabilities and reduce reliance on foreign-owned satellite operators for sensitive government and defence applications. This strategy will allow Optus to assemble mixed LEOSat and GEOSat services utilising its existing GEOSat fleet. Optus also has a trial agreement with Lynk Global and an MOU with AST SpaceMobile.

- Vocus: This enterprise-focused fibre provider has an advanced and diversified satellite strategy. It is a key partner for Starlink’s business services, notably launching Australia’s first private Layer 2 network over the Starlink constellation. This service provides highly secure, internet-free connectivity for enterprise and government clients by establishing private interconnects with Starlink’s network. At the same time, Vocus is positioning itself as a key partner for the next wave of LEO competition, signing a major agreement with Telesat to build its first Australian landing station and integrate its forthcoming Lightspeed services into its enterprise portfolio. Vocus also has a trial agreement with Telesat.

- TPG Telecom: In contrast to some of its rivals, TPG Telecom does not currently offer LEO satellite plans. However, it has a non-exclusive partnership with satellite-to-mobile-phone operator Lynk Global to eliminate mobile coverage dead zones around Australia. TPG is trialling SMS connectivity, and has plans to introduce satellite-based calling to standard phones in the future. TPG also has a trial agreement with Lynk Global.

New Zealand

- One NZ (formerly Vodafone NZ): One NZ has aggressively embraced a partnership with Starlink to pioneer D2M services in the country. It offers satellite-powered TXT messaging to its mobile customers on eligible plans at no extra charge, providing a safety net in areas without terrestrial mobile coverage. This partnership has expanded into the Internet of Things (IoT) space, with One NZ launching a nationwide satellite IoT service that leverages Starlink’s Direct to Cell technology to connect devices in remote locations.

- 2degrees: 2degrees has become an authorized reseller of Starlink for Business. It offers a managed service that bundles Starlink connectivity with 24/7 local support, public IP addresses, and the convenience of a single, integrated 2degrees bill. Under this model, 2degrees manages the Starlink account and acts as the primary point of contact for the business customer, adding a layer of service and support on top of the raw connectivity. 2degrees also has trial agreements with Lynk Global and AST SpaceMobile.

- Spark NZ: New Zealand’s largest telco offers Starlink-powered satellite internet solutions for its small, medium, and large enterprise and government customers. The service is positioned as a high-performance option for businesses in remote locations and as a robust business continuity and resilience solution for sites that require a backup to their primary terrestrial connection. Spark also has a partnership with Lynk Global, announced in 2023, but this does not appear to have passed the trial stage. Spark also has a trial agreement with Lynk Global and AST SpaceMobile.

Specialist providers (ANZ)

Beyond the major telcos, a vibrant ecosystem of specialist satellite service providers has emerged to partner with the LEO operators:

- Sat.One: A key distribution partner for OneWeb across Australia and New Zealand, with a strong focus on the enterprise and maritime sectors. It provides connectivity solutions extending up to 300 nautical miles offshore, serving industries like commercial fishing and offshore energy.

- Pivotel: A multi-network service provider that offers solutions from both OneWeb and Starlink, alongside other satellite operators like Iridium and Inmarsat. This network-agnostic approach allows Pivotel to tailor solutions for enterprise and remote users, enhanced by its value-added service management platform, Pulsar.

- Orion Satellite Systems: Partners with both OneWeb directly and with Vocus for Starlink offerings. Orion provides managed LEO broadband plans featuring its Horizon AI platform, which offers customers enhanced network visibility and control.

- Advantage NZ: A New Zealand-based partner for OneWeb, focusing on delivering its enterprise-grade solutions to the local business market.

The competitive dilemma for telco operators

The intricate network of partnerships reveals a market growing more complex and sophisticated. The decision by major telcos to engage in “co-opetition” – collaborating with LEO providers while simultaneously developing competing or alternative solutions – is a direct result of the strategic dilemma they face.

On one hand, LEO services, particularly Starlink’s D2C offering, pose a threat to the telcos’ business in underserved markets. Ceding these customers is not an option. On the other hand, the capital cost and timeline required to build a proprietary LEO constellation from scratch are prohibitive.

Therefore, the logical short-term strategy is to partner with the new entrants. This allows telcos to immediately offer a competitive LEO product, retain customers who would otherwise churn, and quickly plug gaps in their mobile coverage using D2M technology.

However, this creates a significant long-term dependency on a powerful new competitor. The parallel investments by Optus in its sovereign ‘SWIFT’ project and by Vocus in the next-generation Telesat network are strategic hedges against this very dependency. And despite Starlink’s unmatched scale, telecommunications operators are still supporting smaller contenders who have adopted a wholesale-only business model that does not compete directly with them (which Starlink does).

This complexity is further clarified by the starkly different business models of the primary operators, which are naturally segmenting the market. Starlink’s model, built for massive scale, prioritizes a simple user experience and low-touch, automated customer support, making it ideal for the consumer and small business segments.

In contrast, OneWeb’s model is explicitly designed for the complex needs of enterprise and government clients. It requires deep technical integration, robust security, and guaranteed service levels, which are best delivered and supported by a channel of expert partners like Vocus, Sat.One, and Pivotel.

This leads to a clear division in the competitive landscape. Starlink is capturing the lion’s share of the consumer, SOHO (Small Office/Home Office), and mobility markets.

Meanwhile, OneWeb and its network of value-added resellers are securing the enterprise, government, and mission-critical segments that require a level of assurance and support that Starlink’s standard offering is not designed to provide. These moves are designed to secure a position in the high-value government and defence markets where data sovereignty and supply chain trust are paramount, creating a defensible niche that a foreign-owned D2C provider may struggle to penetrate. This dynamic indicates the market is evolving into a multi-layered ecosystem where telcos will simultaneously act as resellers for, customers of, and future competitors to the global LEO giants.

The competition is thus not merely about technology but about the entire value chain, from sales and installation to ongoing management and security. Specialist partners are carving out a vital and profitable niche by wrapping a layer of management, security, and expert support around the raw LEO connectivity – a service proposition that the D2C model inherently struggles to deliver at scale for complex clients.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.