FORECAST: Australia Video Entertainment Outlook 2025

- Publisher : Venture Insights

- Publish Date : July 16, 2025

Executive Summary

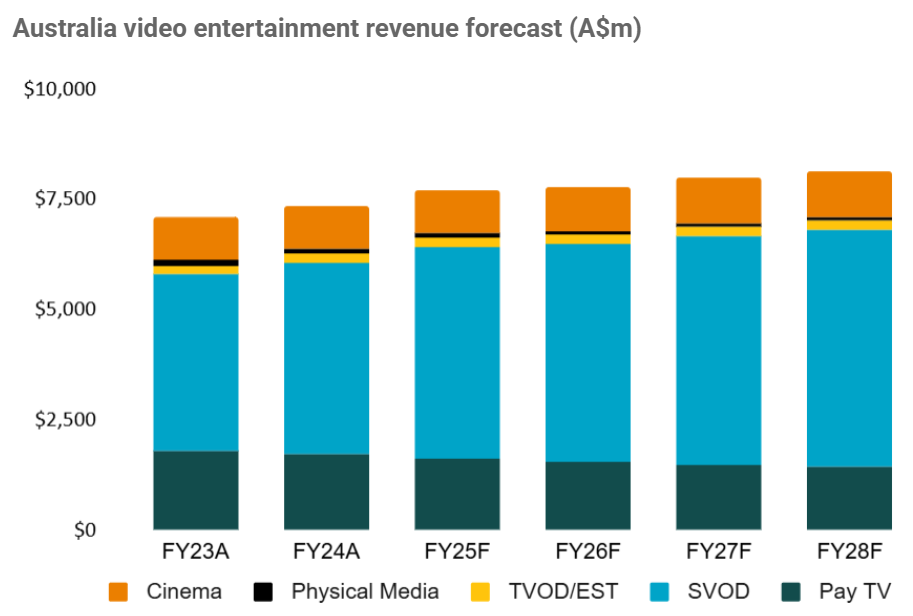

The Australian video market is forecast to grow at a 2.4% CAGR over FY24/29, reaching A$8.28 billion in FY29, primarily driven by SVOD growth.

Specific forecasts include:

- Pay-TV subscriber revenue remains under pressure, and is anticipated to decrease at a -4.2% CAGR, falling from $1.71 billion in FY24 to $1.38 billion in FY29.

- SVOD/IPTV revenue is forecast to grow at 5.0% CAGR from FY24, reaching A$5.55 billion by FY29, propelled mainly by higher ARPU. SVOD revenue growth slows in FY26 as the market digests recent price increases, but we expect more in FY27.

- TVOD/EST revenue of $207m in FY24 is expected to be flat at 0.0% CAGR to FY29. SVOD competition continues to erode EST usage, but TVOD promotion by some SVOD providers will offset the decline.

- Physical Media (DVD/Blu-ray) has been marginalised by online delivery. Revenue is projected to contract at a -8.7% CAGR, falling to A$70 million by FY29.

- Finally, Cinema revenue is forecast to grow 2.0% CAGR, reaching A$1.07 billion in FY29, primarily due to ticket price growth.