REPORT: ANZ Telco-cloud market overview – benefits and risks of co-opetition

- Publisher : Venture Insights

- Publish Date : August 28, 2025

Executive Summary

This report summarises the relationships struck between ANZ telco and global cloud infrastructure, platform, and service providers. These relationships are now crucial to telco efficiency and product development, and are driving usage of both basic and enhanced connectivity. At the same time, it is clear that the platforms are capturing the revenue growth from these developments, while enterprise connectivity revenues languish.

On the cloud provider side, high barriers to entry are a key concern, exacerbated by the immense capital investment required for data centres and the established scale advantages of incumbent providers (noted by the ACCC in its Platforms Inquiry reports). Impediments to switching, or “vendor lock-in,” also pose a significant challenge, citing potentially restrictive egress fees for data transfer out of a provider’s cloud, the use of non-standard APIs and data formats, and long-term committed spend agreements that make it financially unappealing for customers to use multiple providers or switch.

ANZ telcos are significantly affected by these market dynamics. Telcos are increasingly dependent on cloud-native architectures and leveraging cloud service providers for their IT infrastructure and network operations.

While cloud partnerships can offer telcos innovative revenue streams, the dominant market power of hyperscalers means that any anti-competitive practices in cloud and AI services could indirectly increase input costs or limit the innovation options available to telcos. And there are significant risks that cloud providers will encroach on telco customer bases and markets in the future.

Over the next weeks, we will survey the current partnership landscape in Australia and New Zealand in detail. We will then review the potential threats that arise to telcos from the dominance of the cloud oligopoly of Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

ANZ telco/cloud market snapshot

Both the telco and cloud sectors in Australia and New Zealand are characterised by a high concentration of dominant players, a market structure that elevates the strategic importance of any major partnership.

Telecommunications operators

The telecommunications markets in both Australia and New Zealand are mature and highly competitive, defined by a small number of large, vertically integrated operators who own the core network infrastructure.

Australia

The Australian retail market is dominated by four major network operators: Telstra, Singtel Optus, Vocus, and TPG Telecom.

- Telstra is the nation’s largest telco by market share and revenue, operating the most extensive fixed and mobile network. Its strategic focus is on expanding its 5G coverage and enhancing customer service through digital transformation.

- Optus, a subsidiary of Singtel, is the second-largest operator. It maintains a strong competitive position with a portfolio of mobile, internet, and enterprise services.

- Vocus, a privately held company, maintains an extensive portfolio of fixed assets, and targets key enterprise verticals such as government and mining. It has recently boosted its fixed network by acquiring TPG Telecom’s fixed assets, making it the third biggest telco and arguably the number 2 in the fixed market.

- TPG Telecom was formed through a 2020 merger of TPG and Vodafone Hutchison Australia, creating the then third player in the market. The company holds a portfolio of brands, including Vodafone, TPG, and iiNet. It is known for its competitive pricing and, after the sale of its fixed assets, its focus on the mobile segment.

The NBN Co is the main provider of fixed access infrastructure, and operates on a wholesale-only basis by statute. Beyond the big three, the market includes specialised providers like Macquarie Telecom Group, which focuses on business and government clients with telecom and data centre services.

New Zealand

The market structure in New Zealand mirrors that of Australia, with three primary retail network providers: Spark New Zealand, One NZ, and 2degrees.

- Spark New Zealand is the largest telecommunications provider in the country, with a dominant position in both consumer and enterprise markets. Its strategy is heavily focused on 5G rollout, cloud-based solutions, and IoT developments.

- One NZ, rebranded from Vodafone in early 2023, is a major competitor with strong urban coverage and a focus on leveraging its global technology relationships to offer competitive services.

- 2degrees has established itself as the third major player, growing its customer base through aggressive pricing and a focus on customer engagement. In 2022, it merged with Vocus New Zealand, significantly strengthening its fixed-line and enterprise capabilities.

A key entity in the New Zealand infrastructure landscape is Chorus, which was demerged from Telecom (now Spark) in 2011. Chorus owns the majority of the country’s underlying telecommunications access infrastructure and operates on a wholesale-only basis, providing access to a large number of retail service providers.

Hyperscale cloud providers

The global public cloud market is overwhelmingly controlled by three “hyperscalers”: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These three providers collectively account for approximately two-thirds of the worldwide cloud infrastructure market, a dominance that is reflected in the Australia and New Zealand region. Their immense scale, continuous innovation, and comprehensive service portfolios make them indispensable partners for any large enterprise, including telcos, undergoing digital transformation.

- Amazon Web Services (AWS): As the pioneer of the modern cloud computing industry, AWS remains the market leader, holding a global market share of around 31-33%. Launched in 2006, it offers the most extensive and mature portfolio of services, with over 200 fully featured services spanning compute, storage, databases, analytics, machine learning, and more. Its primary strength lies in Infrastructure as a Service (IaaS), where it commands a 40% revenue share, and it is often the preferred choice for organisations with heavy, complex cloud workloads.

- Microsoft Azure: Microsoft’s cloud platform is the second-largest player, having steadily grown its market share to 20-23%. Azure’s key competitive advantage is its deep integration with Microsoft’s vast enterprise ecosystem, including Microsoft 365, Windows Server, and Azure Active Directory. This makes it a natural choice for organisations already heavily invested in Microsoft products. Azure is also particularly strong in hybrid cloud solutions, offering services like Azure Stack and Azure Arc that allow businesses to extend their on-premises data centres into the cloud seamlessly.

- Google Cloud: The third major provider holds a market share of approximately 10-12%. Google Cloud distinguishes itself through its world-class expertise in data analytics, Artificial Intelligence (AI), machine learning (ML), and container orchestration. Services like BigQuery (a serverless data warehouse) and Google Kubernetes Engine (GKE) make GCP a good option for data-centric and tech-forward organisations.

Market dynamics

The concentration of power within both the telecommunications and cloud sectors creates a unique dynamic. The partnerships formed between these dominant players are not merely commercial agreements; they are market-shaping strategic alliances. A deal between a major telco and a hyperscaler can dictate technology standards for entire industries, influence the IT architecture of thousands of enterprise customers, and create significant barriers to entry for smaller competitors.

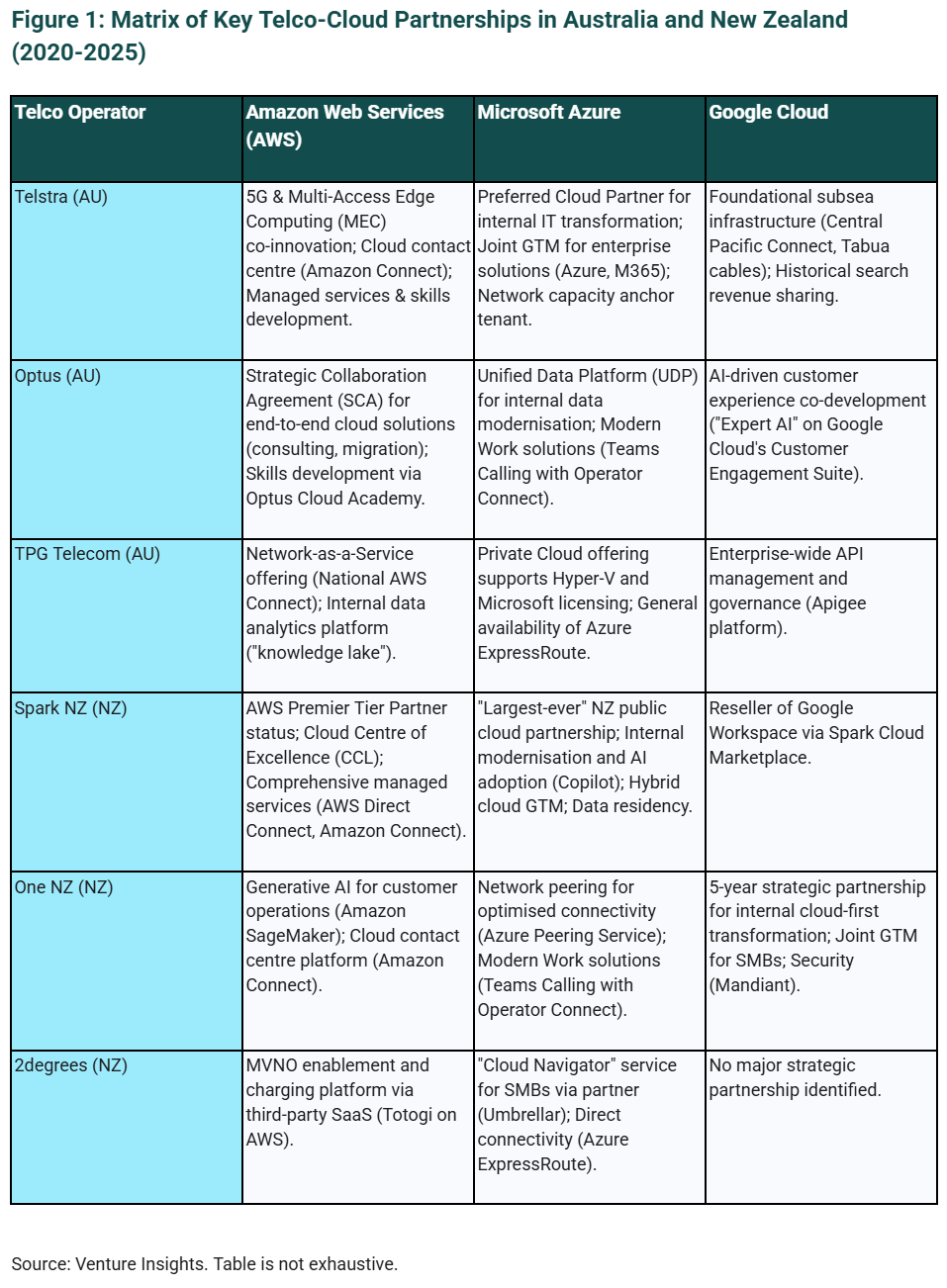

This has led to the formation of a few powerful, integrated ecosystems, where a telco’s network capabilities are deeply intertwined with a cloud provider’s platform. This forces competitors to forge their own deep alliances to remain relevant, leading to the landscape of partnerships summarised in the following table.

Why this matters

These strategic relationships are now key to telcos in three regards:

- Internal operations: cloud is increasingly embedded in telco operations, creating telco dependencies on cloud providers.

- Connectivity: The telco’s enterprise customer connectivity to cloud infrastructure, platforms, and services, bundled with SLAs and security, is now a crucial link between enterprises and the cloud.

- External product: cloud is increasingly embedded in telco product offers through service bundling agreements with cloud operators.

Beyond this, cloud platform companies operate large Over-The-Top (OTT) businesses independently of telcos. Search and social media in the consumer segment, and a host of enterprise applications, are delivered directly to end users. This is now being supplemented with AI applications that are being taken up at very high rates.

In its analysis of the cloud provider market in Australia, the ACCC noted that the top three providers combined hold approximately 80% of the IaaS market, with Microsoft holding an estimated 30.9%, Amazon 30.1%, and Google 20.6% in 2023. This dominance is underpinned by several factors:

- Vertical Integration: These major cloud providers are vertically integrated, providing services across the entire cloud stack (IaaS, PaaS, and Software-as-a-Service, or SaaS) and are making significant investments in generative AI foundation models and integrated AI products. This allows them to control much of the cloud computing and AI supply chain.

- Economies of Scale and Scope: Large incumbent cloud providers benefit from substantial economies of scale and scope, enabling them to deploy computational resources at a significantly lower cost per unit than smaller competitors.

- Significant Investments: Hyperscalers are planning substantial investments in data centres in Australia and globally, particularly for AI-related cloud services. For instance, AWS announced an increase in local data centre investments to $20 billion between 2025 and 2029, and Microsoft pledged over $5 billion for nine new data centres in Australia in 2023.

These partnerships have brought significant benefits to telcos, including operational efficiencies, new markets, and opportunities to add value to basic connectivity. But there are also risks, particularly of encroachment of cloud providers into the relationship between telcos and their customers, and even into telecom markets such as international communications, data centre connectivity, and enterprise access.

In the next weeks, we will look in detail at telco/cloud provider relationships, and analyse the threats posed by growing platform power in the ANZ market.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.