REPORT: Customer Hardship and the AI Paradox: Navigating the Customer Service Tipping Point

- Publisher : Venture Insights

- Publish Date : July 4, 2025

Abstract

Australia’s telecommunications sector is facing a confluence of critical challenges that are testing service delivery and provider resilience. TIO complaints data reveals a significant spike in customers experiencing financial hardship, exposing systemic inflexibility in provider support systems. Concurrently, the increasing frequency of extreme weather events is straining physical network infrastructure, driving service reliability complaints.

As the industry turns to Artificial Intelligence (AI) for efficiency, it confronts a critical paradox: the risk that automation could exacerbate the very human-centric service issues, like handling vulnerable customers, that providers are already struggling to manage effectively. This systemic inflexibility represents a significant service and reputational risk, particularly as the industry pivots towards automated solutions.

Executive Summary

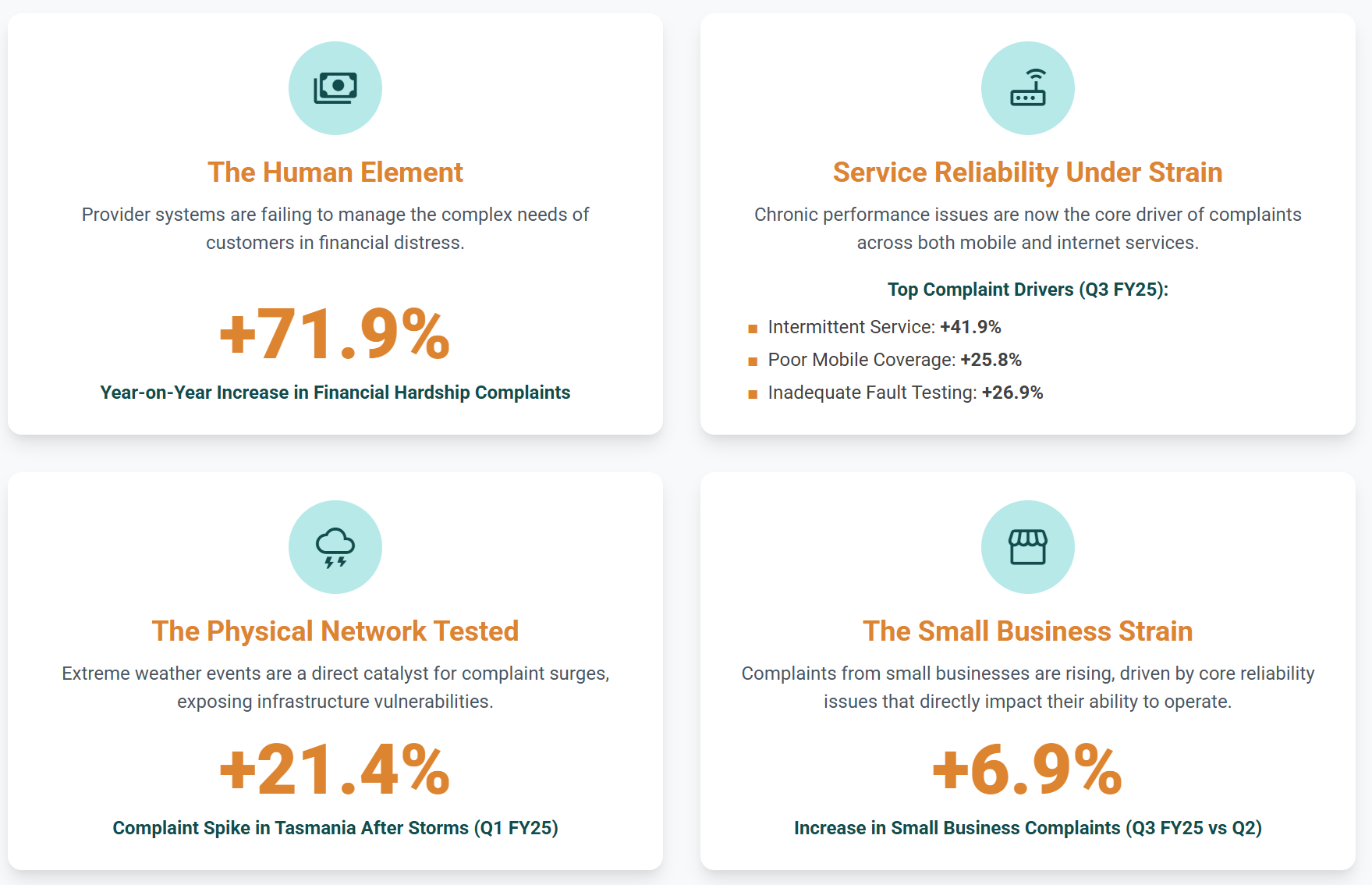

- Financial Hardship Soars: Complaints related to financial hardship and repayment arrangements surged 71.9% in Q3 FY25 compared to the prior year, highlighting growing household budget pressures.

- Mobile Service Reliability is an Issue: Despite a post-3G shutdown dip in mobile complaints, underlying reliability issues dominate. In Q3 FY25, key mobile complaint drivers were intermittent service (up 41.9%), poor mobile coverage (up 25.8%), and inadequate fault testing (up 21.4%).

- Internet Complaints on the Rise: While mobile remains the most complained-about service, internet complaints grew 8.0% in Q3 FY25, closing the gap and signalling that network performance issues are platform-agnostic.

- Small Businesses Feel the Strain: Complaints from small businesses rose for the second consecutive quarter (up 6.9% in Q3 FY25), driven primarily by poor mobile coverage and intermittent service—failures that directly impact their operations.

- Challenger Brands Under Pressure: Several challenger providers are showing signs of strain. In Q3 FY25, TPG Group and Superloop saw total complaints 32.4% and 33.3% respectively compared to the previous quarter, while Circles Australia’s complaints were up 189% year-on-year.

- Event-Driven Volatility: The market remains susceptible to shocks, with the Q2 FY25 complaint load jumping 13% quarter-on-quarter, driven by mobile service issues following the 3G network shutdown.

- The AI Paradox: Telcos are pursuing AI for efficiency, yet the data shows they are struggling with complex, human-centric issues. The TIO Board has noted that the opportunities of AI “must be balanced with the risks for consumer and provider interactions”.

Complaints face potential uptick

The Human Element: Systemic Inflexibility Meets Customer Hardship

Beneath the headline numbers, a clear narrative is emerging: provider systems are struggling to cope with the complex realities of their customers’ lives. The most potent indicator is the 71.9% year-on-year surge in financial hardship complaints.

These are not simple billing disputes; they are cases involving refusal of payment plans, unaffordable arrangements, and premature service disconnections. This suggests that processes designed for standard interactions are failing when faced with non-standard “edge cases.” This systemic inflexibility represents a significant service and reputational risk, particularly as the industry pivots towards automated solutions.

The Physical Element: Climate Stress & Infrastructure Resilience

The reliability of telecommunications infrastructure is being increasingly tested by the physical impacts of extreme weather. This is no longer a hypothetical risk but a direct driver of complaint volumes.

The TIO’s submission to the 2024 Regional Telecommunications Review shows that such events leave consumers facing long repair delays and recurring faults, a situation exacerbated in regional and remote areas with fewer service alternatives. As these climate-related events become more common, the base level of network resilience will become a defining factor in customer experience and a key driver of complaints.

Why does this matter: The AI Paradox

It is striking how poorly the telcos are addressing financial hardship. This is indicative of a bigger problem of how they deal with edge cases in customer service. It points to a lack of training and flexibility in telco customer service.

There is a wider issue here because telcos are keen to move to more AI-based approaches to customer service. Facing these human and physical pressures, the sector is looking to AI and automation as a key solution for efficiency.

However, this creates a critical paradox. The very issues providers are struggling with – nuanced financial hardship cases, complex fault diagnosis – are those that demand a sophisticated, flexible, and often individualised response. Entrusting these tasks to automated systems risks amplifying the systemic inflexibility already evident in the complaints data. The national experience with the Robodebt scheme stands as a stark warning of the consumer detriment that can occur when automated systems are poorly designed and deployed to manage complex human circumstances.

As telcos proceed down the path of automation, the key challenge will be to ensure these systems can deliver on the promise of efficiency without sacrificing the empathy and flexibility required to solve their customers’ most difficult problems. There is a real risk that this could exacerbate the edge case issue, and this cuts across their automation ambitions.

If telcos are going to deliver on a streamlined customer service regime, they will need to convince regulators that they can at least not make things worse, and hopefully improve their performance. In its “Artificial intelligence in communications and media: Occasional paper,” ACMA has said it is actively monitoring the deployment of AI and is considering the need for specific rules, especially around the role of AI in handling customer complaints. Just last week, ACMA reaffirmed its focus on customer service at the CommsDay conference.

Finally, it is critical for telcos that their automation efforts are viewed sympathetically by regulators and governments. Otherwise it will be harder for them to deliver the improved financial performance their investors are demanding.

Appendix: Data Deep Dive: A Q3 FY25 Snapshot

This section provides a granular analysis of the key data tables from the TIO’s Q3 FY25 report.

Service Type Analysis

The Q3 data reveals a significant shift in complaint drivers. While mobile services continue to represent the largest share of complaints at 43.9%, the volume dropped by 8.1% from the previous quarter. This suggests the acute issues that drove the Q2 spike have begun to normalise. Conversely, complaints about internet services rose by a substantial 8.0%. This has narrowed the gap between the two main service categories and indicates that fundamental issues of reliability and service quality are not confined to the mobile network.

Provider Performance Analysis

The performance among providers is markedly varied and points to specific challenges within challenger brands.

- Market Leaders: Telstra and TPG/Vodafone both saw a 4.2% increase in complaints quarter-on-quarter, while Optus Group recorded a 6.7% decrease.

- Challenger Brands: The most significant trend is the sharp rise in complaints for several challenger brands. TPG Group and Superloop experienced substantial quarter-on-quarter increases of 32.4% and 33.3% respectively, though some of this growth is due to rapid total subscriber growth.

- Circles Australia: This provider stands out with a 22.7% increase from the last quarter and a dramatic 189.0% year-on-year increase in complaints. The primary issues were service and equipment fees, excess data and failure to cancel a service.

This data indicates that several challenger brands may be facing scalability issues, where growth is not being matched by support systems, leading to a degraded customer experience.

Key Thematic Insights

The “Key insights at a glance” summary reinforces the report’s primary themes:

- Service Reliability: The top drivers for mobile complaints are now fundamental service quality issues: intermittent service or dropouts, poor mobile coverage, and inadequate fault testing.

- Small Business Dissatisfaction: Complaints from small businesses rose for a second consecutive quarter (up 6.9%), primarily driven by poor mobile coverage and intermittent service.

- Financial Hardship: The 71.9% year-on-year increase in financial hardship complaints remains a critical trend.

- Regional Resilience and Vulnerability: Despite Cyclone Alfred, complaints in Queensland fell 6.6%. However, the Northern Territory saw the highest proportional increase in complaints at 31.6%, highlighting the variability of service in regional areas.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.