REPORT: Google’s Grand Reset – From Search Giant to Sovereign System

- Publisher : Venture Insights

- Publish Date : June 20, 2025

Abstract: Google is no longer just a search engine – it’s positioning itself as the digital operating system for life. This pivot is not merely technological – it represents a deliberate attempt to reshape the digital economy around a proprietary, AI-first ecosystem. This will radically reshape how users discover content, make decisions, and interact online. For Australia and New Zealand, this transformation carries profound risks: collapsing media revenues, deeper dependence on foreign infrastructure, and eroded digital sovereignty.

This report unpacks Google’s strategic ambitions, the threat to Australia’s and New Zealand’s open web and telco sectors, and the scope for broader economic entrapment via software and cloud licensing. Without bold regulatory intervention, we face a future locked into a high-cost, low-control digital ecosystem controlled from offshore. The implications for Australia and New Zealand are significant, echoing two strategic vulnerabilities Venture Insights has previously flagged: the erosion of media diversity (Appendix A) and an overdependence on foreign digital infrastructure (Appendix B).

Search Is Eating the Market – And Local Media With It

Venture Insights’ advertising market forecasts underscore the structural shift towards digital channels, with digital search solidifying its position as the single largest category. In FY25 in Australia alone, digital search is projected to generate A$7.3 billion, eclipsing both television (A$3.7 billion) and digital display (A$6.1 billion). This trajectory continues through FY30, when digital search is expected to reach A$8.3 billion, accounting for over 30% of Australia’s total ad market.

The continued growth of search, even in a maturing market, reflects its unparalleled reach, measurable ROI, and strategic alignment with evolving consumer discovery behaviour – particularly as search becomes increasingly powered by AI. An estimated 68% of internet activity starts on search engines and about 90% of searches happen on Google. Google holds significant sway over internet activity, with an estimated 68% of online journeys beginning on search engines and roughly 90% of those searches occurring on Google. If the internet is a garden, Google functions as the sun, enabling its growth.

This growth also illustrates the risks posed by Google’s evolving AI-driven ecosystem. As Google transitions from a search engine to a fully agentic platform (see Appendix C), the company is poised to capture an even greater share of this expanding market. If consumers bypass brand websites in favour of AI-curated responses and transactions within Google’s walled garden, then local advertisers, publishers, and retailers may find themselves locked into increasingly expensive and opaque ecosystems. The scale and entrenchment of digital search revenue – already surpassing all other ad formats – means Google’s dominance in this domain could extend from market leadership to market gatekeeping.

An immediate effect is that views that would previously have gone to websites and social media, generating display advertising revenue, will remain within Google’s new search ecosystem. This poses a threat to both traditional and social media rivals including the free-to-air TV industry, Meta, and X.

1. From Search Engine to Operating System for Life

But Google’s agentic AI systems aim to provide not just search results, but curated answers, decisions, and transactions. This keeps users locked within the Google ecosystem – bypassing the open web and traditional media entirely. As noted in our report Breaking the Consensus, this outcome aligns closely with our “AI-Powered Global Takeover” scenario where AI platforms dominate content creation, distribution, and monetisation.

In effect, Google is attempting to become the interface layer for both consumers and businesses – consolidating everything from shopping and travel to media consumption, transport services, and enterprise ICT services.

2. Impacts on Media, Advertising and Discovery

By intercepting user interaction and delivering answers directly, Google’s strategy threatens to disintermediate a wide range of digital players – from local publishers and broadcasters to online retailers and travel aggregators. In this scenario, open web traffic shrinks while “agentic” AI platforms hoard consumer attention.

This shift is already impacting ANZ digital advertising markets. As outlined in Appendix A, such developments accelerate the decline of legacy media models and mirror the ad spend outcomes we forecast under AI-dominant trajectories.

3. Sovereignty and the Licence Trap

More broadly, Google’s strategy intensifies our already critical dependency on foreign tech vendors. The new AI layer is built on the same dynamics Venture Insights documented in The $10 Billion Bill – where SaaS licensing and cloud lock-ins from US giants (Google, Microsoft, Amazon) extract billions annually with little local value capture.

This brings mounting national risks:

- Data sovereignty is compromised as AI interactions occur on foreign infrastructure.

- Domestic IT and media sectors become margin-thin resellers, lacking bargaining power or technological leverage.

- Strategic autonomy erodes as Google’s AI systems become essential utilities.

- These systemic risks are outlined in detail in Appendix B.

4. Regulatory Response is Crucial – but Missing

Despite the scale of change, Australia and New Zealand remain largely unprepared. The existing policy toolkit – focused narrowly on content moderation or digital bargaining codes – is ill-suited for platform-wide economic reconfiguration. As Appendix A notes, other jurisdictions like the EU and Canada are experimenting with structural reforms, including data localisation and digital service tariffs.

Absent action, we risk locking in a new era of digital dependence – this time not just on foreign software, but on foreign decision-making systems.

When the Interface Becomes the Empire

How Google’s AI Could Centralise Control Over Decisions, Markets, and Minds

If Google succeeds in executing its AI strategy, it will no longer be just a gateway to the internet – it will become the internet’s operating layer. With over 1.5 billion users already engaging with AI-generated search results each month and the rollout of agentic capabilities such as booking, purchasing, and personalised recommendations, Google is positioning itself as the default interface for consumer decision-making. As detailed in Appendix C, these advancements – powered by Gemini models and multimodal search – go far beyond improving search; they rewire it entirely, turning Google from a directory into a destination.

This transformation is not limited to consumer behaviour. Google is embedding its AI agents across cloud platforms, enterprise tools, advertising infrastructure, and even physical devices – from Android phones and headsets to autonomous vehicles. Its enterprise-grade tools like Vertex AI, Agent Designer, and Distributed Cloud are turning Google into a foundational layer for business operations. With strategic AI integration across products that reach billions globally, the company is en route to becoming an unregulated utility – a digital nervous system that sits invisibly but inescapably between users and outcomes, as laid out in Appendix C.

Should Google realise this vision, its dominance will extend beyond economics into behavioural and informational influence. Every search, every ad, every consumer and enterprise decision will be guided by its agentic systems. The company will control the infrastructure, the logic layer, and increasingly, the decision-making itself. This centralisation challenges the open web, reduces media plurality, and puts Australia and New Zealand – as both markets and policymaking entities – on the back foot. In this scenario, we don’t just license software or cloud services from abroad; we lose our personal agency, outsourcing human choices to a foreign algorithm.

Conclusion

Google’s AI strategy is not simply a company pivot – it’s a redefinition of the digital economy’s operating model. For Australia and New Zealand, the challenge is no longer theoretical. The decisions made now will shape the country’s media resilience, economic sovereignty, and competitive standing for the next decade.

Appendix A – Google’s strategy through the lens of our report “Breaking the Consensus: future media scenarios”.

Appendix B – Strategic parallels with our report “The $10 Billion Bill”.

Appendix A: Alignment with “Breaking the Consensus – Future Media Scenarios”

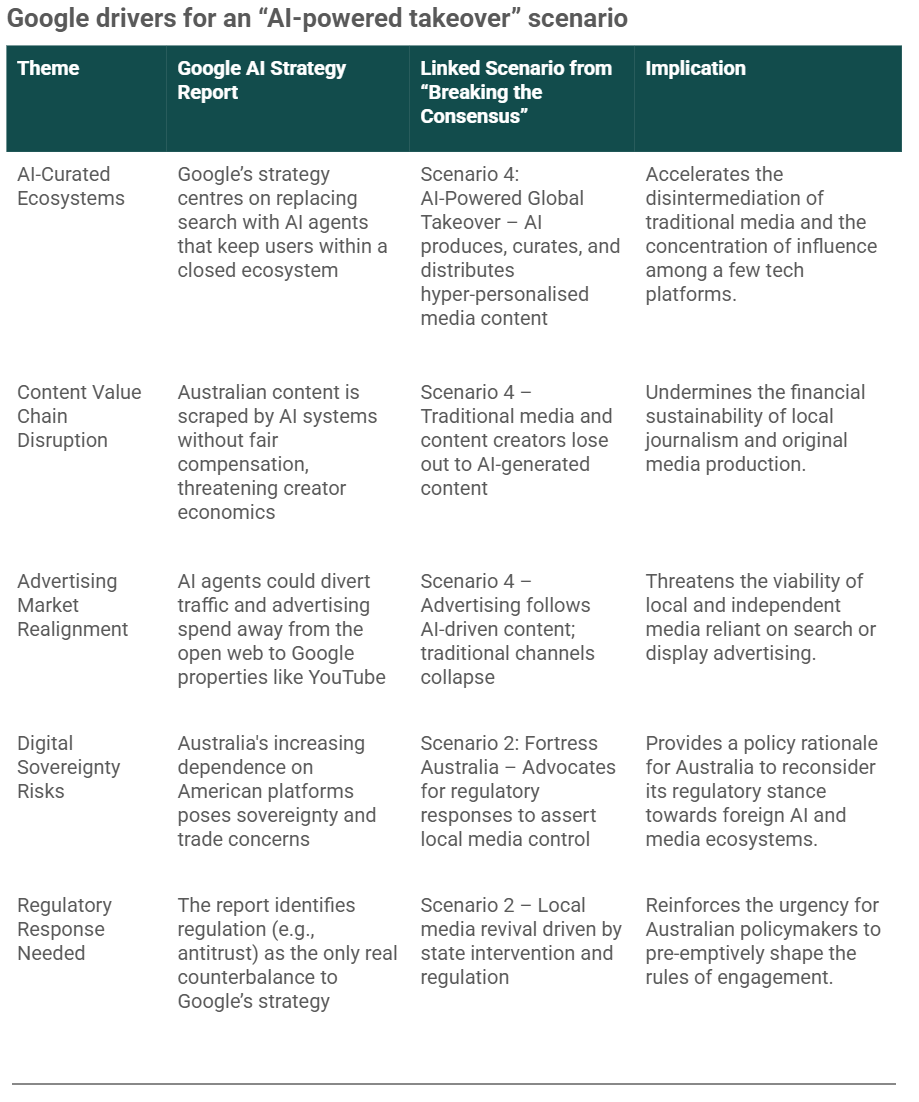

The insights in Google’s AI Ambitions – A Strategic Shift with Broad Implications strongly align with the “AI-Powered Global Takeover” scenario outlined in our April 2025 report Breaking the Consensus – future media scenarios. Below, we map these alignments and contextualise the findings for the Australian and New Zealand media and digital economy:

This appendix illustrates how Google’s AI strategy is not an isolated development, but rather a concrete manifestation of the “AI-powered” scenario we anticipated. It also strengthens the case for scenario-based strategic planning across ANZ’s media and tech sectors. Let me know if you’d like to visualise this in a chart or incorporate it into the full report.

Appendix B: Strategic Parallels with “The $10 Billion Bill” Report

The insights into Google’s AI-centric strategy extend the same structural risks highlighted in The $10 Billion Bill report – namely, Australia’s (and New Zealand’s) deepening economic dependence on foreign technology vendors. Below, we synthesise the interconnections:

Appendix C: Google’s Strategic AI Arsenal – Products, Pipelines, and Platform Power

Google’s shift toward becoming an AI-native platform is powered by an expansive and vertically integrated ecosystem of products and capabilities. Its strategy spans infrastructure, consumer products, enterprise services, and foundational models – creating a self-reinforcing moat that extends its market dominance well beyond traditional search.

I. Agentic Search and AI Integration

Google’s reimagined Search, now underpinned by Gemini models, introduces deeply “agentic” capabilities:

- AI Overviews: Already reaching 1.5 billion users monthly, generating AI summaries directly in Search.

- AI Mode: Offers advanced reasoning, multimodal answers, and deeper web queries via Gemini 2.5.

- Deep Search: Enables expert-level reports via hundreds of automated subqueries.

- Search Live: Uses live camera input to power interactive, real-time queries.

- Project Mariner: Facilitates task execution – e.g., bookings and purchases – through partnerships with major commerce platforms.

- AI Shopping Partner and Personal Context: Enhance consumer decision-making by integrating purchase intent and personal data.

- Custom Charts and Graphs, Circle to Search, and Lens: Visualise complex data and expand multimodal search capabilities.

These features exemplify the “agentic” AI model discussed in the main report, enabling Google to function as a transactional intermediary rather than a referral engine.

II. AI Models and Research

Google’s Gemini family anchors its AI strategy:

- Gemini 2.5 Pro: Industry-leading multimodal AI.

- Gemini 2.5 Flash: Optimised for cost-efficient deployment.

- Gemini Robotics, Gemma 3, and AlphaEvolve: Expand applications in robotics, open models, and scientific discovery.

- Imagen 3, Veo 2, AlphaFold, and Flow: Extend generative AI into images, video, biology, and filmmaking.

These models are increasingly embedded into every Google service, reinforcing vertical integration and data lock-in.

III. Infrastructure Power

Google maintains one of the most advanced global compute networks:

- Over 2 million miles of fiber and 33 subsea cables.

- TPUs (e.g., Ironwood) and NVIDIA GPU partnerships underpin scalable inference.

- Google was the first to offer Blackwell GPUs; new Vera Rubin GPUs are next.

This infrastructure is central to Google’s ability to serve enterprise and sovereign AI clients, reinforcing Australia’s and New Zealand’s reliance as highlighted in Appendix B.

IV. Android and Devices

AI is being embedded across:

- Pixel and Android: Gemini-powered tools like Live Camera, AI assistants, and Gemini Docs.

- Enterprise Android: Biometric security, APN overrides, and task automation.

- Wearables and XR: Gemini will soon power glasses, headsets, and other interfaces.

These developments reinforce Google’s cross-device reach, creating AI continuity from mobile to enterprise settings.

V. Google Cloud & AI Agents

Google Cloud enables:

- Vertex AI: Access to 200+ foundation models.

- Google Distributed Cloud and Sovereign AI: In-country deployment for compliance.

- Agent Development Kit and Agent Designer: Tools for building enterprise-grade AI agents.

- Google Agentspace: Combines conversational AI and enterprise search for firms like KPMG.

This makes Google not just a consumer AI platform but also a foundational layer for enterprise operations – deepening its strategic role in Australia’s and New Zealand’s digital infrastructure.

VI. YouTube and Monetisation

- 270+ million paid subscriptions across Alphabet.

- 20 billion videos; Shorts and TV viewing are primary engagement drivers.

- Innovations like Creator Takeover and reservation-based ads diversify monetisation channels.

- YouTube continues to absorb consumer attention and ad dollars, undermining traditional broadcasters and aligning with the disintermediation trend outlined in Appendix A.

VII. Advertising and Marketing AI

Google uses LLMs to:

- Match ads with long-tail queries and personalise placements.

- Generate lifestyle images and auto-optimise media buys.

- Deliver asset-audience recommendations across campaigns (e.g., PMax, Demand Gen).

- AI-driven advertising closes the loop – Google controls the discovery, decision, and transaction phases.

VIII. Autonomous Driving (Waymo)

- 250,000+ weekly paid rides across major US cities.

- Partnerships with Uber, expansion into freeway and airport pickups.

- Waymo, although still nascent in Australia and New Zealand , signals Google’s broader ambition to embed AI into physical infrastructure and transportation.

IX. Additional Subscriptions and Productivity Tools

- Google Workspace, NotebookLM, and Google AI Ultra expand professional-grade AI tools.

- Gemini in Workspace powers 2 billion AI assists per month.

- These services reinforce Google’s dual role: AI toolmaker and platform provider, both at the consumer and enterprise layer.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.