BRIEF: Mobile price rises are now a fixture in the Australian market

- Publisher : Venture Insights

- Publish Date : May 22, 2025

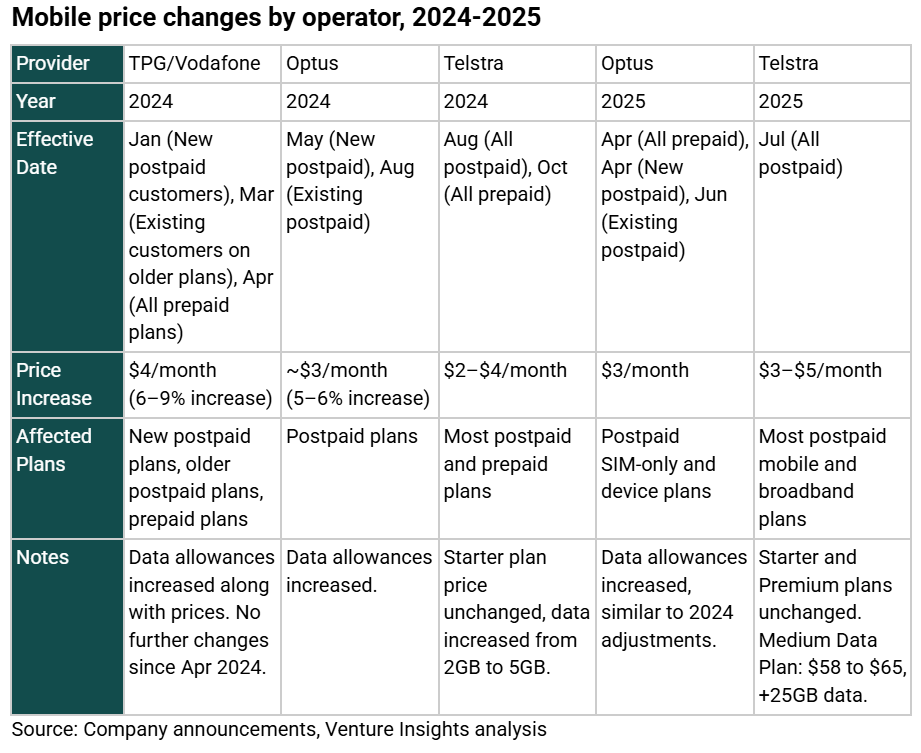

Abstract: Since the beginning of 2024, we have witnessed all three mobile network operators (MNOs) lift their mobile prices significantly. Optus and Telstra have now announced two rounds of significant price increases over 2024-2025.

These price moves have been justified as necessary to address mobile network investment needs and rising operating costs. There is no reason to doubt this – continued investment is inescapable, while rising input costs (including capital costs) have affected the whole economy.

The result is likely to be further price rises in the future. This will raise tensions with customers, but the three MNOs are in a position to maintain discipline on pricing.

Mobile prices on the rise

2024 changes

The trend towards higher mobile prices was kicked off in a modest fashion in early 2024 by Vodafone:

- New postpaid customers faced a roughly $4/month price hike in January 2024.

- This was followed by a similar hike for existing customers in March 2024, but only those on older plans, and did not impact customers who signed up to a newer Vodafone plan in 2024 or 2025, or those upgrading to 2024 and 2025 plans. The increases ranged from 6–9%.

- Finally, the prices for all 3 of Vodafone’s prepaid starter packs was increased by $5 From April 10.

Since then, Vodafone prices have been stable. In 2025, Vodafone’s priority is to grow customer share by leveraging the expanded coverage it gained through its network sharing deal with Optus.

This was followed by Optus raising prices for new postpaid customers in May 2024, with existing customers seeing increases from August 2024. The price hikes were approximately 5–6%, with postpaid plans increasing by $3/month. For example, the cheapest postpaid plan went from $49 for 30GB to $52 for 50GB.

Alongside the price increase, Optus boosted data allowances, with standard Choice plans gaining an extra 20GB or 40GB of full-speed data per month. This adjusted the cost per gigabyte to $0.20–$0.80, down from $0.22–$1.04.

Telstra joined in by announcing price increases effective from August 2024 for postpaid customers and October 2024 for prepaid customers. The increases ranged from $2 to $4 per month across most plans. The Premium postpaid plan increased by up to $4/month, adding $48 annually for affected customers. The Starter postpaid plan remained unchanged in price, with its data allowance increasing from 2GB to 5GB per month starting August 27, 2024. The main 28-day prepaid plans saw a $4 increase, with all plans receiving larger data allowances.

These changes followed Telstra’s announcement in early 2024 that it was dropping CPI-linked increases in 2024. We noted at the time that this was likely to free Telstra to move prices in response to costs rather than CPI (see our report “Ending CPI price rises – Telstra seeks flexibility”).

2025 changes

In March 2025, Optus announced a $4 per month hike in its prepaid plans. This was followed by postpaid price hikes for new customers in April, passed on to existing customers in June. The increase was $3/month across postpaid plans, both for SIM-only and device plans. Data allowances were also increased, similar to 2024.

And just this week, Telstra announced its own round of price increases. Telstra announced price increases for most of its postpaid mobile and mobile broadband plans, effective from July 1, 2025. The key details are:

- Most postpaid mobile and mobile broadband plans will rise by $3 to $5 per month. For example, the Medium Data Plan will increase from $58 to $65 per month, with an additional 25GB of data included.

- The Starter mobile plan and prepaid mobile plans will not see price changes. The Premium mobile plan also remains unchanged in price.

The changes listed above are summarised in the following table.

Why does this matter?

There were price increases by all three major MNOs in 2023 as well. This is a reversal of the long term trend of real price declines before that time. We have now seen significant mobile price increases across all MNOs for three years in a row (Telstra and Optus more than Vodafone). Are we now seeing an annual ritual? Certainly, something has changed.

Even MVNOs have not been immune from this trend. Telstra-based MVNOs (e.g. Tangerine, More, Exetel, Superloop) saw modest $1–$5/month increases in March and April 2025. There is little visibility into wholesale mobile pricing, but retail price increase must eventually flow into wholesale if the MNOs are to retain market share. Rising MVNO prices may be a signal this is happening.

Cost pressure

In its most recent announcement, Telstra cited rising costs and the need to invest in network performance, reliability, and security, including an $800 million investment over four years to enhance its mobile network. These factors have been a feature of most of the price announcements listed above, and we have no reason to doubt this.

One factor here that is rarely raised is the effects of capital costs. Global interest rate increases since the pandemic have lifted the Weighted Average Cost of Capital (WACC) for all, including telecommunications operators. Of the three MNOs only Telstra recovers its cost of capital. This in turn has led to heightened investor scrutiny of operators’ Return on Invested capital (ROIC) performance. It is notable that TPG introduced this measure into its accounts in 2023.

While the cost of capital is now falling, it probably won’t fall to the low levels of the pandemic, and may not even get back to where it was before the pandemic. If it doesn’t, then there will be ongoing pressure for telecommunications prices to move to a new, higher level.

Customer backlash

This will generate challenges for the MNOs. There are clear indications of customer frustration. The traditional approach of increasing data allowances to offset the hikes is losing traction as some customers felt the extra data was superfluous to their needs.

But as long as the three major operators maintain discipline, they will be in a position to ride out customer complaints. There is no alternative to bringing prices into line with costs, so this is a bitter pill that customers and the industry will need to swallow.

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.