BRIEF: SCA exits regional TV – the end of a media policy era

- Publisher : Venture Insights

- Publish Date : June 26, 2025

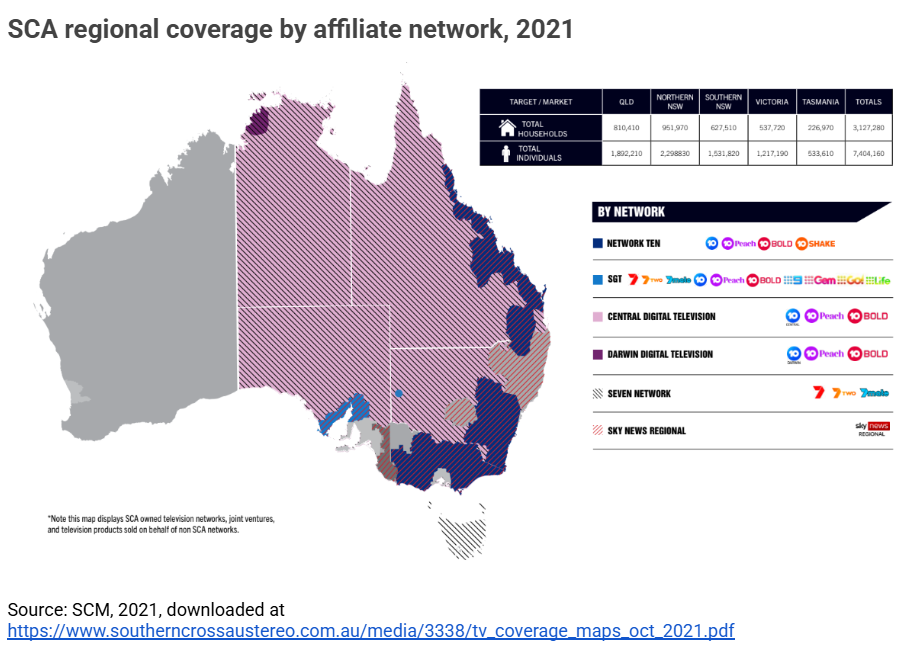

Abstract: On 30 June, Southern Cross Austereo (SCA) will complete its sale of its Seven Network affiliates to Seven West Media. This follows a sale of its Ten Network affiliates to the Ten Network in the aggregated markets of Queensland, southern New South Wales, and Victoria, agreed in December 2024. With these sales, SCA has exited the television market.

Regional broadcasting in Australia was the product of the Hawke Government’s ‘equalisation’ policy. This policy saw affiliates of all three metropolitan networks set up in the major “aggregated” markets in regional Australia, bringing diversity and competition. But the rise of BVOD services, which are exclusively owned by the metropolitan broadcasters, took away regional TV’s growth engine. The policy response was to change the cross-media rules in 2017 to allow metropolitan networks to acquire regional licences. With this transaction, that process is all but complete, laying a platform for future regional viability.

SCA completes sale of its TV licences

On May 6, 2025, Seven West Media (SWM) announced a binding agreement to acquire television licenses and associated assets from Southern Cross Austereo (SCA) for $3.75 million in cash. The assets include regional television licenses in Tasmania, Darwin, Spencer Gulf, Broken Hill, Mt Isa, and Remote, Central, and Eastern Australia. These licenses currently broadcast Seven Network programming under an existing affiliation agreement with SCA, so the deal will leave viewers unaffected. The transaction closes on June 30 and is projected to be immediately earnings-accretive for SWM in fiscal year 2026.

This follows an earlier deal with Network Ten (Paramount) in December 2024 for the sale of SCA’s regional television licenses in the three aggregated markets of Queensland, southern New South Wales, and Victoria to Network 10, owned by Paramount Global. These licenses currently broadcast Network 10 programming (channels 10, 10 Bold, 10 Peach, and Nickelodeon) under regional affiliation agreements with SCA. It is understood that that deal involves payments to SCA over a period of five years totalling $15-20m.

These transactions are part of SCA’s strategic review of its non-core regional television assets, aligning with its focus on its “All About Audio” strategy, which emphasises its online and broadcast audio businesses. SCA is seeing significant growth in its online audio advertising revenues; SCA’s audio segment reported a 9% revenue increase for the first four months of 2025. The audio industry has been less volatile since the pandemic than television, and SCM has seen its future there for several years.

Previous deals have fallen over mainly on disagreements over price. However, we have argued that the logic of these acquisitions by SWM and Ten has been inexorable since the change in cross-media regulation in 2017. Prior to that time, a single network could not exceed 75% of national audience reach. But with the removal of that rule, regional acquisitions by metropolitan networks became possible. (see our report “Media market trends ensure a SCA TV deal – sooner or later”).

That logic saw the Prime Network was acquired by SWM in 2022. Bruce Gordon’s WIN Corporation was the main regional affiliate for Nine, and is more integrated with Nine through cross-holdings. SCM then held the bulk of the remaining available regional licences, some of which were affiliated with Seven and some with Ten.

Why does this matter?

The introduction of full television competition in the major regional markets was the outcome of the Hawke Government’s equalisation policy. This saw three main affiliates in each market, who partnered with metropolitan networks for their program content. This system worked for decades, and regional TV licensees made significant investments in local news context as part of their licence conditions.

The rise of online streaming alternatives placed significant pressure on the entire Australian TV industry. But the problem has been especially acute for regional broadcasters. An early court ruling found that the affiliate agreements did not include the online distribution of content. This meant that the regional broadcasters could not launch BVOD streaming services. In contrast, there was nothing to prevent the metropolitan networks from offering BVOD in regional markets.

While BVOD viewing is still only 12% of total free-to-air TV viewing, it is the growth engine of TV. Lacking that growth engine, the regional TV industry’s days of independence were numbered.

For SWM and Ten, these deals strengthen their businesses in several ways:

- Expanded Reach: The acquisition extends SWM’s and Ten’s broadcast reach to nearly 100% of Australia’s population.

- Digital Synergies: The deal strengthens SWM’s and Ten’s digital platforms, by allowing broadcast/online cross-marketing in these regional markets. This enables advertisers to target broader audiences across broadcast and digital campaigns, potentially driving incremental revenue.

- Financial Impact: The SWM transaction is expected to be earnings-accretive in FY26, boosting SWM’s revenue, earnings, and cash flow. The modest $3.75 million cash outlay suggests a cost-effective expansion. The stock price surge of nearly 18% reflects investor confidence in the deal’s value. The Ten deal is more complex and harder to evaluate, but gives Ten direct access to the major regional markets in the eastern States, significantly boosting their network coverage and audience.

- Strategic Transformation: SWM’s CEO, Jeff Howard, emphasized that the acquisition is a key step in the company’s ongoing transformation, leveraging its leading news, sport (e.g., AFL, Cricket Australia), and entertainment content to capture new markets. Beverley McGarvey, President of Network 10 and Head of Streaming & Regional Lead at Paramount Australia, stated the deal reinforces Paramount’s commitment to the Australian market and Network 10’s national footprint, enhancing advertising opportunities for commercial partners.

For SCA, the sale is a significant step in a strategic pivot to its radio and digital audio assets, including Triple M, Hit Network, and LiSTNR.

- Strategic Refocus: The sale aligns with SCA’s “All About Audio” strategy, allowing it to divest non-core television assets and concentrate on its digital and broadcast audio segments, such as radio.

- Financial Benefits: The $3.75 million cash from SWM, combined with the Ten divestitures, will help SCA reduce its net debt, with a forecast leverage ratio below 1.5x by June 30, 2025. This strengthens SCA’s financial position, enabling a planned resumption of dividends in FY25.

- Operational Momentum: SCA reported a 9% increase in audio revenues for the first four months of 2025, exceeding prior guidance, and a 7% rise for the ten months to April 2025. The divestment supports this momentum by streamlining operations and focusing resources on high-growth audio segments.

- Market Positioning: By exiting regional TV, SCA avoids the competitive pressures of television broadcasting, where digital disruption has challenged smaller players. This allows SCA to strengthen its hyper-local radio approach, enhancing its appeal to advertisers in audio markets.

As a result, SCA’s share price has risen over 20% since its low of October 2024.

This outcome reflects a broadly successful transition, from the regionalised television broadcasting system of the 1980s to a more centralised system in the 2020s. Regional transmission costs remain high, and it remains challenging to fund coverage as total TV revenues are much lower than ten years ago. Funding local news is also a challenge (see our report “Regional TV’s crisis: a new approach needed”). However, consolidation will help. Coupled with the recent stabilisation of free-to-air TV viewing, a platform for regional viability now exists (see our report “2024 VOZ data shows FTA TV has stabilised”).

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.

For more information go to ventureinsights.com.au or contact us at contact@ventureinsights.com.au.