DASHBOARD: Enterprise ICT valuation comps for October 2024

- Publisher : Venture Insights

- Publish Date : November 4, 2024

This Enterprise ICT Valuation report provides a comprehensive analysis of key financial metrics for enterprise ICT stocks listed in Australia and New Zealand (ANZ). It includes detailed visualisations of monthly and annual share price movements, key earnings multiples, and forward earnings multiples compared to forward growth estimates. Additionally, it tracks share price trends over the past twelve months, offering valuable insights for market participants.

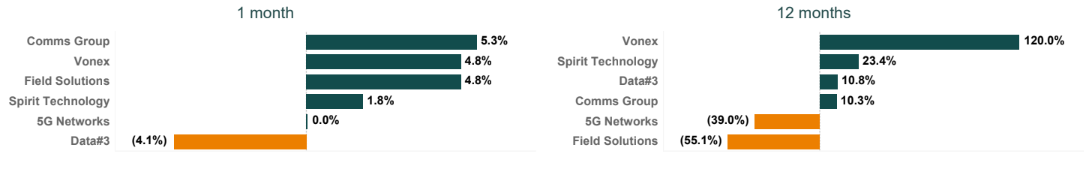

Figure 1: ANZ enterprise ICT share price changes October 2024

Key developments

Enterprise ICT stocks in Australia and New Zealand showed mixed performance over the last year. Overall, economic growth is expected to be sluggish relative to previous years, creating uncertain performance for enterprise ICT equities. Some of these companies are growing through acquisition rather than organically, and are exposed to any economic downturn.

Comms Group

Comms Group’s stock has gained around 5% over the last month despite there being no price sensitive announcements from the company. During September, the Comms Group announced that it was awarded a major contract in partnership with Vodafone to provide IP based voice services to a leading global SaaS provider. The initial contract will deliver over $2.4m in revenue to Comms Group from upfront and ongoing service fees over a 3-year minimum term, with additional revenue to come from usage-based charges.

Vonex

Vonex’s stock price is up nearly 5% in the last month, as the bidding war between MaxoTel and Swoop to acquire the company continues to unfold. During October Swoop, using its 19.9% ownership of Vonex voted against the scheme to accept MaxoTel’s ~$15m offer placed in September, and subsequently made a counteroffer. Swoop’s new offer on 18 October was for 1 fully paid Swoop share for every 4.2 Vonex shares, valuing the company at an implied ~$18m. On 23 October, MaxoTel countered with a cash offer for all Vonex’s shares valuing the company at ~$16m. On 28 October Vonex’s directors unanimously recommended shareholders accept the latest MaxoTel offer to acquire Vonex’s shares.

Field Solutions

Field Solutions stock increased by around 5% over the last month. During early October the company announced that it has finalised a working capital facility of up to $5m from the Kestrel Structured Capital Fund. As a part of the agreement, Field Solutions is issuing warrants valued at ~$1.1m exercisable within a 5 year period. Kestrel Structured Capital Fund is a current shareholder of Field Solutions.

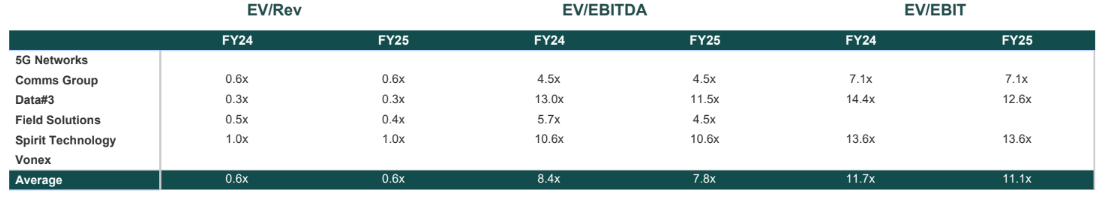

Figure 2: ANZ enterprise ICT valuation multiples October 2024

About Venture Insights

Venture Insights is an independent company providing research services to companies across the media, telco and tech sectors in Australia, New Zealand, and Europe.